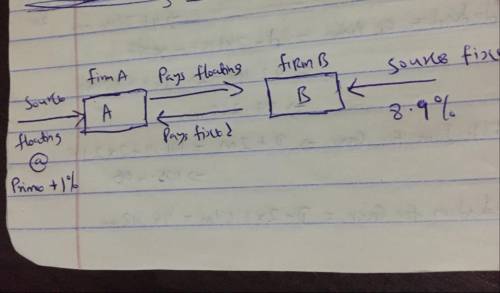

Consider the borrowing rates for Parties A and B. A wants to finance a $100,000,000 project at a FIXED rate. B wants to finance a $100,000,000 project at a FLOATING rate. Both firms want the same maturity, 5 years.

Fim Fixed Rate Floating

A $10.3% Prime + 1%

B $8.900 Prime +4%

Construct a mutually beneficial INTEREST ONLY swap that makes money for A, B, and the swap bank IN EQUAL MEASURE.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 14:10, gia2038

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

Business, 22.06.2019 16:30, piratesfc02

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

Business, 22.06.2019 21:40, goku4420

Inventory by three methods; cost of goods sold the units of an item available for sale during the year were as follows: jan. 1 inventory 20 units at $1,800 may 15 purchase 31 units at $1,950 aug. 7 purchase 13 units at $2,040 nov. 20 purchase 16 units at $2,100 there are 18 units of the item in the physical inventory at december 31. determine the cost of ending inventory and the cost of goods sold by three methods, presenting your answers in the following form: round your final answers to the nearest dollar. cost inventory method ending inventory cost of goods sold a. first-in, first-out method $ $ b. last-in, first-out method $ $ c. weighted average cost method $ $

Answers: 3

Business, 23.06.2019 01:30, stranger123

At the end of the fiscal year, apha airlines has an outstanding non-cancellable purchase commitment for the purchase of 1 million gallons of jet fuel at a price of $4.10 per gallon for delivery during the coming summer. the company prices its inventory at the lower of cost or market. if the market price for jet fuel at the end of the year is $4.50, how would this situation be reflected in the annual financial statements?

Answers: 2

You know the right answer?

Consider the borrowing rates for Parties A and B. A wants to finance a $100,000,000 project at a FIX...

Questions in other subjects:

Spanish, 27.10.2020 16:00

Computers and Technology, 27.10.2020 16:00

Mathematics, 27.10.2020 16:00

Physics, 27.10.2020 16:00

Computers and Technology, 27.10.2020 16:00

Biology, 27.10.2020 16:00