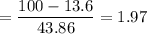

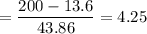

Assume that the returns from an asset are normally distributed. The average annual return for this asset over a specific period was 13.6 percent and the standard deviation of those returns in this period was 43.86 percent. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. What about triple in value? (Do not round intermediate calculations and enter your answer as a percent rounded to 6 decimal places, e. g., .161616.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 18:00, kaitlynmoore42

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 22.06.2019 09:50, thanitoast84

Acar manufacturer uses new machines that automatically assemble an engine from parts fed to the system. the machine can regulate the speed ofassembly depending on the number of parts produced. which type of technology does this machine use? angenoem mense wat ons in matin en esta va ser elthe machine uses

Answers: 3

Business, 22.06.2019 19:00, Anonymouslizard

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

You know the right answer?

Assume that the returns from an asset are normally distributed. The average annual return for this a...

Questions in other subjects:

Social Studies, 28.11.2021 14:00

Social Studies, 28.11.2021 14:00

Mathematics, 28.11.2021 14:00

History, 28.11.2021 14:00

English, 28.11.2021 14:00

Biology, 28.11.2021 14:00

History, 28.11.2021 14:00

Mathematics, 28.11.2021 14:00