Business, 12.08.2020 06:01 criser1987zach

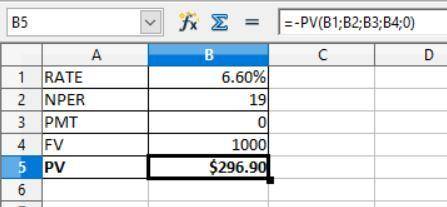

What is the value of a zero-coupon bond with a par value of $1,000 and a yield to maturity of 6.60%? The bond has 19 years to maturity.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 17:30, dondre54

Emery pharmaceutical uses an unstable chemical compound that must be kept in an environment where both temperature and humidity can be controlled. emery uses 825 pounds per month of the chemical, estimates the holding cost to be 50% of the purchase price (because of spoilage), and estimates order costs to be $48 per order. the cost schedules of two suppliers are as follows: vendor 1 vendor 2 quantity price/lb quantity price/lb 1-499 $17 1-399 $17.10 500-999 $16.75 400-799 $16.85 1000+ $16.50 800-1199 $16.60 1200+ $16.25 (a) what is the economic order quantity for each supplier? (b) what quantity should be ordered and which supplier should be used? (c) the total cost for the most economic order sire is $

Answers: 2

Business, 22.06.2019 20:10, NorbxrtThaG

Assume that a local bank sells two services, checking accounts and atm card services. the bank’s only two customers are mr. donethat and ms. beenthere. mr. donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his atm card. ms. beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her atm card. assume that the bank can provide each of these services at zero marginal cost. refer to scenario 17-5. if the bank is unable to use tying, what is the profit-maximizing price to charge for a checking account

Answers: 3

Business, 22.06.2019 22:00, ugh788o02

The company is experiencing an increase in competition, and at the same time they are building more production facilities in southeast asia. in this scenario, the top management team is most likely to multiple choice increase the cost of their products. restructure to reflect a more bureaucratic, stable organization. pull decision-making responsibility from low-level management, taking it on themselves. give lower-level managers the authority to make decisions to benefit the firm. rid themselves of all buffering product.

Answers: 3

Business, 23.06.2019 10:00, dani595

Bagwell's net income for the year ended december 31, year 2 was $189,000. information from bagwell's comparative balance sheets is given below. compute the cash received from the sale of its common stock during year 2. at december 31 year 2 year 1 common stock, $5 par value $ 504,000 $ 453,600 paid-in capital in excess of par 952,000 856,600 retained earnings 692,000 585,600

Answers: 3

You know the right answer?

What is the value of a zero-coupon bond with a par value of $1,000 and a yield to maturity of 6.60%?...

Questions in other subjects:

Mathematics, 27.02.2020 01:25

Biology, 27.02.2020 01:25

History, 27.02.2020 01:25

Biology, 27.02.2020 01:25

Mathematics, 27.02.2020 01:25