Business, 12.08.2020 07:01 calebmoore925

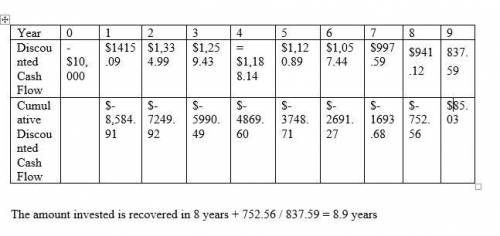

If a project has a cost of $10,000, expected net cash flows of $1500 a year for 12 years and you use a discount rate of 6%,

1. What is the following:

a. Payback period (no application of discount rate)

b. Payback period (using discount rate)

c. NPV

d. IRR

2. Should the project be accepted?

3. If another project has a cost of $10,000 and has expected life of 8 years and it will generate $3000 a year should you accept the project if your boss says the cost of capital is 5%?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 18:20, montamonta0204

Which of the following housing decisions provides a person with both housing and an investment? a. selling a share in a cooperative. b. buying a single-family home. c. renting an apartment. d. subletting a condominium. 2b2t

Answers: 2

Business, 22.06.2019 00:30, joshdunsbuns143

How did lani lazzari show her investors she was a good investment? (site 1)

Answers: 3

Business, 22.06.2019 11:10, takaralocklear

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

You know the right answer?

If a project has a cost of $10,000, expected net cash flows of $1500 a year for 12 years and you use...

Questions in other subjects:

History, 22.07.2019 21:50

History, 22.07.2019 21:50

Biology, 22.07.2019 21:50

Mathematics, 22.07.2019 21:50

Geography, 22.07.2019 21:50

Physics, 22.07.2019 21:50