Business, 27.07.2020 01:01 madelynlittle5399

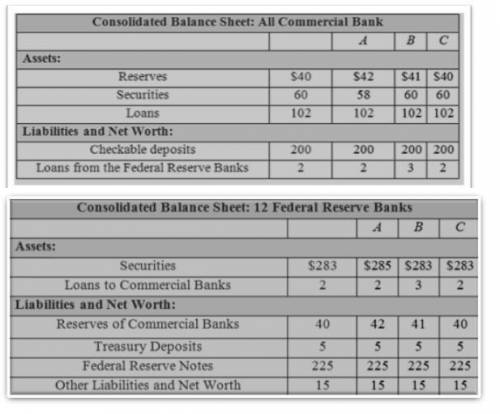

Use commercial bank and Federal Reserve Bank balance sheets to demonstrate the immediate effect of each of the following transactions on commercial bank reserves. Assume that the initial reserve ratio is 20 percent. Fill in the new balances in the column in the balance sheets that correspond with each of the following transactions. Consider each transaction separately, not cumulatively.

a. Federal Reserve Banks purchase $2 billion worth of securities from banks.

b. Commercial banks borrow $1 billion from Federal Reserve Banks at the discount rate.

c. The Fed reduces the reserve ratio from 20 percent to 19 percent.

Instructions: Enter your answers as whole numbers in the gray-shaded cells of both tables below.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, gtamods402

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 14:20, ssalusso7914

Cardinal company is considering a project that would require a $2,725,000 investment in equipment with a useful life of five years. at the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. the company’s discount rate is 14%. the project would provide net operating income each year as follows: sales $2,867,000 variable expenses 1,125,000 contribution margin 1,742,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $706,000 depreciation 465,000 total fixed expenses 1,171,000 net operating income $571,000 1. which item(s) in the income statement shown above will not affect cash flows? (you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. any boxes left with a question mark will be automatically graded as incorrect.) (a)sales (b)variable expenses (c) advertising, salaries, and other fixed out-of-pocket costs expenses (d) depreciation expense 2. what are the project’s annual net cash inflows? 3.what is the present value of the project’s annual net cash inflows? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 4.what is the present value of the equipment’s salvage value at the end of five years? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 5.what is the project’s net present value? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.)

Answers: 2

Business, 22.06.2019 19:40, madisynk78

Adistinguishing feature of ecological economics is the concept of cost-benefit analysis steady-state economies that, like natural systems, neither grow nor shrink environmental damage and also environmental benefits are external greenwashing to increase public acceptance of products the only healthy economy is one that is growing

Answers: 1

Business, 22.06.2019 19:40, ashley4329

Anita has been named ceo of a popular sports apparel company. as ceo, she is tasked with setting the firm's corporate strategy. which of the following decisions is anita most likely to makea) whether to pursue a differentiation or cost leadership strategy b) which customer segments to target c) how to achieve the highest levels of customer satisfaction d) what range of products the firm should offer

Answers: 2

You know the right answer?

Use commercial bank and Federal Reserve Bank balance sheets to demonstrate the immediate effect of e...

Questions in other subjects:

Mathematics, 15.03.2022 01:40

Mathematics, 15.03.2022 01:40

Mathematics, 15.03.2022 01:40

Mathematics, 15.03.2022 01:40

Mathematics, 15.03.2022 01:40

Biology, 15.03.2022 01:40