Business, 19.07.2020 14:01 lflugo6oyn4sp

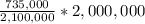

Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $2,000,000. According to independent appraisals, the fair values were $840,000 (building A) and $525,000 (building B) for the buildings and $735,000 for the land. Required: Determine the initial valuation of the buildings and the land.

Asset Initial Valuation

Land

Building A

Building B

Total

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:40, GreenHerbz206

Prior to its closing, income summary had total debits of $1,190,500 and total credits of $1,476,300. what purpose is served by the income summary account and what is the nature of the entries that resulted in the $1,190,500 and the $1,476,300? the income summary account is used to the accounts. the $1,190,500 represents the , and the $1,476,300 represents . the company had of $ .

Answers: 1

Business, 21.06.2019 23:10, josie311251

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. required: a. journalize the adjusting entry to record the accrued fees on december 31. refer to the chart of accounts for exact wording of account titles. b. if the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary?

Answers: 2

Business, 22.06.2019 15:30, barstr9146

Brenda wants a new car that will be dependable transportation and look good. she wants to satisfy both functional and psychological needs. true or false

Answers: 1

Business, 22.06.2019 17:00, kiahbryant12

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

You know the right answer?

Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $2,0...

Questions in other subjects:

Mathematics, 10.11.2021 21:40

Mathematics, 10.11.2021 21:40

English, 10.11.2021 21:40

Medicine, 10.11.2021 21:40

SAT, 10.11.2021 21:40

SAT, 10.11.2021 21:40