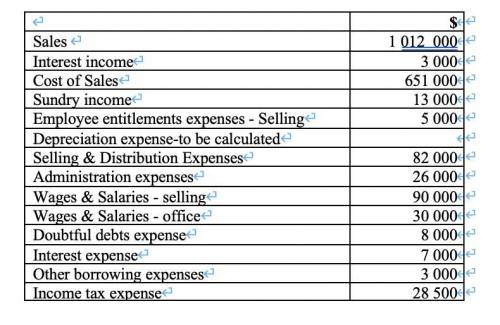

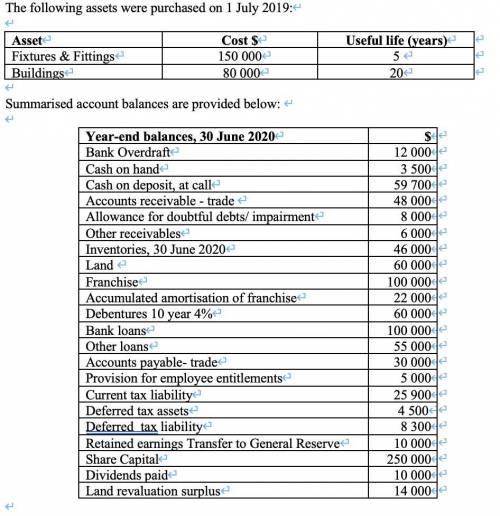

GETFIT Ltd, a retail sports equipment company, commenced operations on 10 May 2019 by issuing 200 000 $1.25 shares, payable in full on application on a first-come, first-served basis. By 20 June 2019 the shares were fully subscribed and duly allotted. There were no share issue costs. The company did not commence trading until 1 July 2019. For the year ending 30 June 2020, the company recorded the following aggregate transactions: $ Sales 1 012 000 Interest income 3 000 Cost of Sales 651 000 Sundry income 13 000 Employee entitlements expenses - Selling 5 000 Depreciation expense-to be calculated Selling & Distribution Expenses 82 000 Administration expenses 26 000 Wages & Salaries - selling 90 000 Wages & Salaries - office 30 000 Doubtful debts expense 8 000 Interest expense 7 000 Other borrowing expenses 3 000 Income tax expense 28 500 The following additional information was noted during the preparation of financial statements for the year ended 30 June 2020: (a) A cash dividend of 5 cents per share was declared and paid during the 2020 financial year and a final dividend for 2020 of $22 000 was proposed but not recognised in the financial statements. (b) The land was revalued upward by $20 000 (related income tax 6 000) by Real Valuations Pty Ltd during the year ended 30 June 2020. (c) Transferred $10 000 out of retained earnings into general reserve. (d) $40 000 of other loans is repayable in one year. (e) The Bank loan is for 5 years and repayable in full at the end of the term. The interest rate is 7% and it is secured over the land. (f) The provision for employee entitlements includes $4 000 payable within 1 year. (g) GETFIT Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement. (h) GETFIT Ltd measures inventory at the lower of cost and net realizable value. The cost model is applied to buildings, plant and equipment. The following assets were purchased on 1 July 2019: Asset Cost $ Useful life (years) Fixtures & Fittings 150 000 5 Buildings 80 000 20 Summarised account balances are provided below: Year-end balances, 30 June 2020 $ Bank Overdraft 12 000 Cash on hand 3 500 Cash on deposit, at call 59 700 Accounts receivable - trade 48 000 Allowance for doubtful debts/ impairment 8 000 Other receivables 6 000 Inventories, 30 June 2020 46 000 Land 60 000 Franchise 100 000 Accumulated amortisation of franchise 22 000 Debentures 10 year 4% 60 000 Bank loans 100 000 Other loans 55 000 Accounts payable- trade 30 000 Provision for employee entitlements 5 000 Current tax liability 25 900 Deferred tax assets 4 500 Deferred tax liability 8 300 Retained earnings Transfer to General Reserve 10 000 Share Capital 250 000 Dividends paid 10 000 Land revaluation surplus 14 000 Required: For the year ending 30 June 2020 (NOTE: comparative financial statements are not required), 1. Using the pro forma table supplied in appendix B, prepare a preliminary trial balance for Getfit Ltd; (5 Marks) 2. Prepare a statement of comprehensive income for Getfit Ltd in accordance with the requirements of AASB 101. Getfit Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement; (15 marks) 3. Prepare a statement of changes in equity for Getfit Ltd in accordance with the requirements of AASB 101; (8 marks) 4. Prepare a statement of financial position for Getfit Ltd in accordance with AASB 101. Use the current/non-current presentation format; (12 marks) 5. Prepare appropriate notes to the accounts. (You do not need to prepare notes related to income taxes. Include the following note as note 1. You may optionally add accounting policies to this note): (20 marks). “1. Summary of significant accounting policies Basis of accounting The financial report is a general purpose financial report which has been prepared on the historical cost basis, except where stated otherwise. Statement of Compliance The financial statements have been prepared in accordance with the requirements of the Corporations Act, Australian Accounting Standards which include Australian equivalents to International Financial Reporting Standards (AIFRSs) and AASB Interpretations. Compliance with AIFRSs ensures the financial statements and notes comply with International Financial Reporting Standards”

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:10, amunson40

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

Business, 22.06.2019 11:10, Emmaxox715

Yowell company granted a sales discount of $360 to a customer when it collected the amount due on account. yowell uses the perpetual inventory system. which of the following answers reflects the effects on the financial statements of only the discount? assets = liab. + equity rev. − exp. = net inc. cash flow a. (360 ) = na + (360 ) (360 ) − na = (360 ) (360 ) oa b. na = (360 ) + 360 360 − na = 360 na c. (360 ) = na + (360 ) (360 ) − na = (360 ) na d. na = (360 ) + 360 360 − na = 360 na

Answers: 1

Business, 22.06.2019 13:50, Jessieeeeey

Classify each of the following items as a public good, a private good, a natural monopoly good, or a common resource.(a) measles vaccinations (b) tuna in the pacific ocean (c) airline service in the united states (d) local storm-water system

Answers: 1

You know the right answer?

GETFIT Ltd, a retail sports equipment company, commenced operations on 10 May 2019 by issuing 200 00...

Questions in other subjects:

French, 22.07.2021 19:40

Mathematics, 22.07.2021 19:40

Mathematics, 22.07.2021 19:40

History, 22.07.2021 19:40