Business, 14.07.2020 01:01 jfleming733

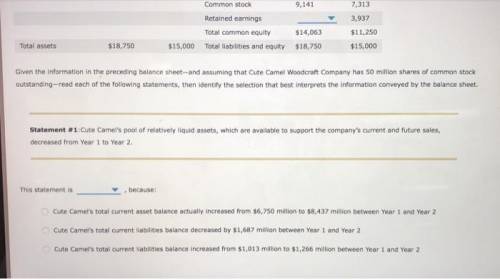

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance. Cute Camel Woodcraft Company is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Cute Camel Woodcraft CompanyBalance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Assets Liabilities and equity Current assets: Cash and equivalents Accounts rece vable Inventories Total current assets Net fixed assets Net plant and equipment Current liabilities: $2,767 Accounts payable $0 176 996 $0 1,266 3,712 8,437 1,013 Accruals 2,970 Notes payable $6,750 Total current liabilities 937 $937 2,813 $3,750 Long-term debt 3,515 8,250 Total debt $4,687 Common equity: Common stock Retained earnings 9,141 7,313 3,937 Common stock Retained earnings Total common equity 9,141 7,313 Y 3,937 11,250 $15,000 $14,063 Total assets $18,750 15,000 Total liabilities and equity $18,750 Given the information in the preceding balance sheet-and assuming that Cute Camel Woodcraft Company has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet.

Cute Camel's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2

This statement is, because:

A) Cute Camel's total current asset balance actually increased from $6,750 million to $8,437 million between Year 1 and Year 2

B) Cute Camel's total current liabilities balance decreased by $1,687 mililion between Year 1 and Year 2

C) Cute Camel's total current liabilities balance increased from $1,013 million to $1,266 million between Year 1 and Year 2

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 00:30, kierafisher05

You wants to open a saving account. which account will grow his money the most

Answers: 1

Business, 22.06.2019 01:30, ghollins

Suppose the following items were taken from the balance sheet of nike, inc. (all dollars are in millions.) 1. cash $ 2,316.7 7. inventory $ 2,245.6 2. accounts receivable 2,786.2 8. income taxes payable 80.3 3. common stock 2,841.1 9. equipment 1,783.8 4. notes payable 291.2 10. retained earnings 6,162.5 5. buildings 3,959.7 11. accounts payable 2,624.6 6. mortgage payable 1,092.3 perform each of the following. classify each of these items as an asset, liability, or stockholders’ equity, and determine the total dollar amount for each classification. (enter amounts in millions up to 1 decimal place, e. g. 45.5 million.) cash accounts receivable common stock notes payable buildings mortgage payable inventory income taxes payable equipment retained earnings accounts payable assets $ 13092 liability $ 4088.4 stockholders’ equity $ 9003.6 etextbook and media determine nike’s accounting equation by calculating the value of total assets, total liabilities, and total stockholders’ equity. (enter amounts in millions up to 1 decimal place, e. g. 45.5 million.) total assets = total liabilities + total stockholders’ equity

Answers: 3

Business, 22.06.2019 10:00, caz27

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i. e., to have ebit = zero?

Answers: 1

You know the right answer?

The balance sheet provides a snapshot of the financial condition of a company. Investors and analyst...

Questions in other subjects:

Chemistry, 03.03.2021 21:50

Advanced Placement (AP), 03.03.2021 21:50

English, 03.03.2021 21:50

Mathematics, 03.03.2021 21:50

Mathematics, 03.03.2021 21:50

Computers and Technology, 03.03.2021 21:50

Arts, 03.03.2021 21:50