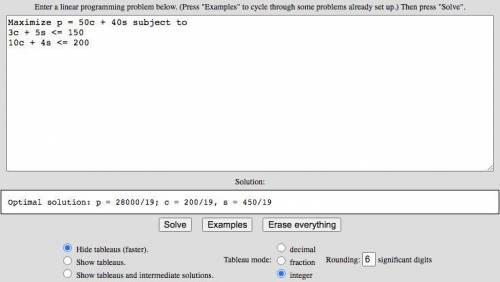

A tailor makes wool tweed sport coats and wool slacks. He is able to get a shipment of 150 square yards of wool cloth from Scotland each month to make coats and slacks, and he has 200 hours of his own labor to make them each month. A coat requires 3 square yards of wool and 10 hours to make, and a pair of slacks requires 5 square yards of wool and 4 hours to make. The tailor earns $50 in profit from each coat he makes and $40 from each pair of slacks. He wants to know how many coats and pairs of slacks to produce to maximize profit.

a. Formulate an integer linear programming model for this problem.

b. Determine the integer solution to this problem by using the computer. Compare this solution with the solution without integer restrictions and indicate whether the rounded-down solution would have been optimal.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:40, rusa25

On december 31, 2011, daggett company issued $750,000 of ten-year, 9% bonds payable for $700,353, yielding an effective interest rate of 10%. interest is payable semiannually on june 30 and december 31. prepare journal entries to reflect (a) the issuance of the bonds, (b) the semiannual interest payment and discount amortization (effective interest method) on june 30, 2012, and (c) the semiannual interest payment and discount amortization on december 31, 2012. round amounts to the nearest dollar.

Answers: 2

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 15:00, AldecuaF10

Beagle autos is known for its affordable and reliable brand of consumer vehicles. because its shareholders expect to see an improved rate of growth in the coming years, beagle's executives have decided to diversify the company's range of products so that at least 40 percent of the firm's revenue is generated by new business units. however, the company's resources, capabilities, and competencies are limited to producing other forms of motorized vehicles, such as motorcycles and all-terrain vehicles (atvs). which type of corporate diversification strategy should beagle pursue?

Answers: 1

Business, 22.06.2019 18:50, gucc4836

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

You know the right answer?

A tailor makes wool tweed sport coats and wool slacks. He is able to get a shipment of 150 square ya...

Questions in other subjects:

Social Studies, 05.01.2020 13:31

Social Studies, 05.01.2020 13:31

Mathematics, 05.01.2020 13:31

Health, 05.01.2020 13:31

English, 05.01.2020 13:31