Business, 03.07.2020 17:01 ayoismeisjjjjuan

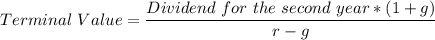

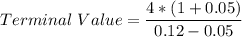

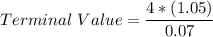

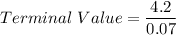

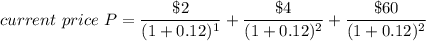

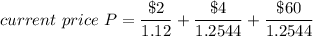

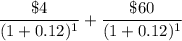

A company will pay a $2 per share dividend in 1 year. The dividend in 2 years will be $4 per share, and it is expected that dividends will grow at 5% per year thereafter. The expected rate of return on the stock is 12%.

Required:

a. What is the current price of the stock?

b. What is the expected price of the stock in a year?

c. Show that the expected return, 12%, equals dividend yield plus capital appreciation.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 20:20, gbrightwell

Reynolds corp. factors $400,000 of accounts receivable with mateer finance corporation on a without recourse basis on july 1, 2015. the receivables records are transferred to mateer finance, which will receive the collections. mateer finance assesses a finance charge of 1 ½ percent of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. the transaction is to be recorded as a sale. required: a. prepare the journal entry on july 1, 2015, for reynolds corp. to record the sale of receivables without recourse. b. prepare the journal entry on july 1, 2015, for mateer finance corporation to record the purchase of receivables without recourse— think through this. c. explain the difference between sale of receivables with recourse as oppose to without recourse.

Answers: 2

You know the right answer?

A company will pay a $2 per share dividend in 1 year. The dividend in 2 years will be $4 per share,...

Questions in other subjects:

Physics, 22.09.2019 06:00

History, 22.09.2019 06:00

History, 22.09.2019 06:00

History, 22.09.2019 06:00