Business, 04.07.2020 01:01 lailabirdiemae

An investment offers $9,600 per year for 16 years, with the first payment occurring 1 year from now. Assume the required return is 12 percent.

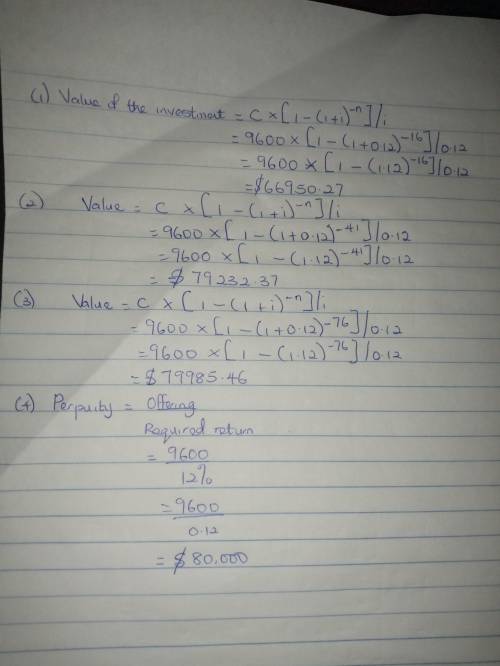

Requirement 1:

What is the value of the investment? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 2:

What would the value be if the payments occurred for 41 years? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 3:

What would the value be if the payments occurred for 76 years? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Requirement 4:

What would the value be if the payments occurred forever? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).)

Value of the investment $

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:30, fjjjjczar8890

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 13:30, Mariaisagon9050

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

Business, 22.06.2019 15:10, emilypzamora11

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

You know the right answer?

An investment offers $9,600 per year for 16 years, with the first payment occurring 1 year from now....

Questions in other subjects:

Geography, 23.01.2020 22:31

Mathematics, 23.01.2020 22:31

Mathematics, 23.01.2020 22:31

English, 23.01.2020 22:31

Mathematics, 23.01.2020 22:31