Business, 01.07.2020 16:01 Lizzyloves8910

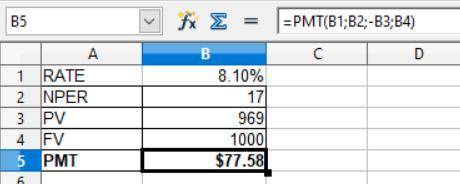

Big Canyon Enterprises has bonds on the market making annual payments, with 17 years to maturity, a par value of $1,000, and a price of $969. At this price, the bonds yield 8.1 percent. What must the coupon rate be on the bonds?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, Dericktopsom

Which of the following pairs is most similar to each other? a. barter goods and fiat money b. digital money and barter goods c. fiat money and digital money d. commodity money and digital money

Answers: 1

Business, 22.06.2019 09:40, cerna

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 11:40, thedarcieisabelleand

Select the correct answer. which is a benefit of planning for your future career? a. being less prepared after high school. b. having higher tuition in college. c. earning college credits in high school. d. ruining your chances of having a successful career.

Answers: 2

You know the right answer?

Big Canyon Enterprises has bonds on the market making annual payments, with 17 years to maturity, a...

Questions in other subjects:

History, 15.07.2019 21:30

History, 15.07.2019 21:30

Mathematics, 15.07.2019 21:30