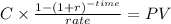

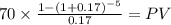

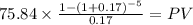

An electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental Problem, but it would not be required to do so. The plant without mitigation would cost $209.71 million, and the expected cash inflows would be $70 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $75.84 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 17%.a) Calculate the NPV and IRR with and without mitigation.

b) How should the environment effects be dealt with when evaluating this project?

c) Should this project be undertaken? If so, should the firm do the mitigation?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:10, kelseydavid69

Sarah needs to complete financial aid packets. during which school year would she do this? sophomore freshman senior junior

Answers: 2

Business, 22.06.2019 08:30, franstirlacci

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 12:50, iamhayls

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 14:30, 20guadalupee73248

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

You know the right answer?

An electric utility is considering a new power plant in northern Arizona. Power from the plant would...

Questions in other subjects:

Chemistry, 14.01.2021 04:40

Mathematics, 14.01.2021 04:40

Physics, 14.01.2021 04:40

Mathematics, 14.01.2021 04:40