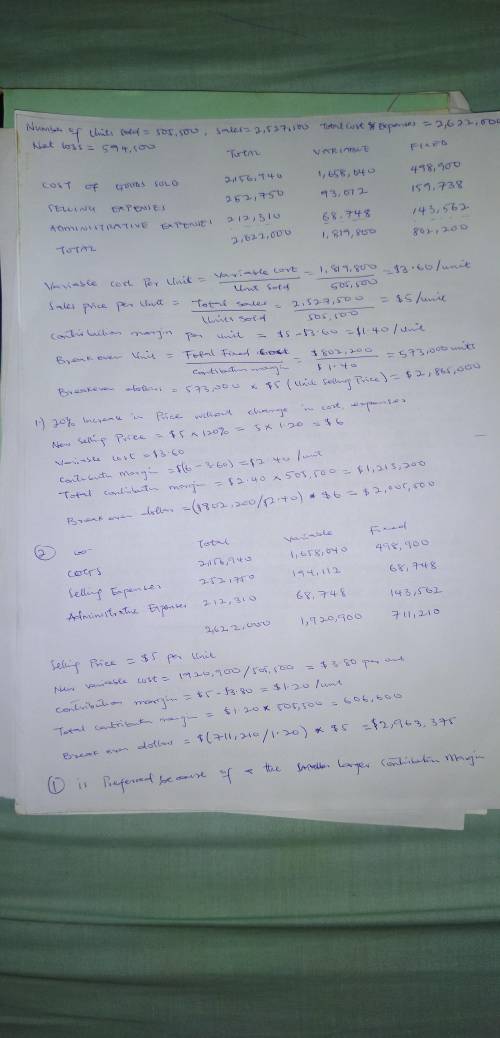

Crane Corps sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 505,500 units of product: sales $2,527,500, total costs and expenses $2.622.000, and net loss 594,500. Costs and expenses consisted of the amounts shown below. Cost of goods sold Selling expenses Administrative expenses Total $2,156,940 252,750 212,310 $2,622,000 Variable $1,658,040 93,012 68,748 $1,819,800 Fixed $498,900 159,738 143,562 $802,200 Management is considering the following independent alternatives for 2021.

1. Increase unit selling price 20% with no change in costs, expenses, and sales volume.

2. Change the compensation of salespersons from fixed annual salaries totaling $151,650 to total salaries of $60,660 plus a % commission on sales.

Compute the break-even point in dollars for 2020.

Compute the contribution margin under each of the alternative courses of action. Contribution margin for alternative

1 Contribution margin for alternative

2 Compute the break-even point in dollars using the contribution margin ratio under each of the alternative courses of action Break-even point for alternative

1 Break-even point for alternative

2 Which course of action do you recommend?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:10, lorrainetakai1738

Suppose that the free states of eldricia, a small nation, has consumption, investment, government purchases, imports, and exports as follows. consumption $140 investment $50 government purchases $45 imports $30 exports $15 calculate the free states of eldricia's gdp

Answers: 2

Business, 22.06.2019 11:40, Josias13

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 16:40, michibabiee

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

You know the right answer?

Crane Corps sales slumped badly in 2020. For the first time in its history, it operated at a loss. T...

Questions in other subjects:

Mathematics, 20.09.2019 23:50

Spanish, 20.09.2019 23:50

Mathematics, 20.09.2019 23:50

Mathematics, 20.09.2019 23:50

Mathematics, 20.09.2019 23:50