Business, 10.06.2020 18:57 mwest200316

Acquisition of Land and Building

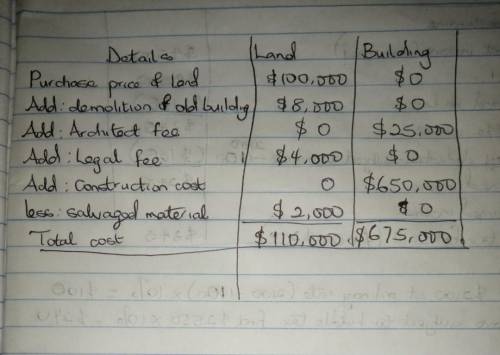

On February 1, 2016, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2016. Costs incurred during this period are:

Demolition of old building $8,000

Architect’s fees 25,000

Legal fees for title investigation and purchase contract 4,000

Construction costs 650,000

Edwards sold salvaged materials resulting from the demolition for $2,000.

Required:

At what amount should Edwards record the cost of the land and the new building, respectively?

If an input box should be blank, enter a zero.

Land Building

Purchase price of land $ $

Demolition of old building

Architect's fees

Legal fees

Construction costs

Salvaged materials

Total

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:00, skcats7353

Ashare stock is a small piece of ownership in a company ture or false

Answers: 2

Business, 22.06.2019 09:50, sanam3035

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 11:10, nataliahenderso

Which feature is a characteristic of a corporation?

Answers: 1

Business, 22.06.2019 12:50, 22iungj

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

You know the right answer?

Acquisition of Land and Building

On February 1, 2016, Edwards Corporation purchased a parcel of lan...

Questions in other subjects:

Mathematics, 12.03.2021 21:10

Mathematics, 12.03.2021 21:10

Biology, 12.03.2021 21:10

History, 12.03.2021 21:10

Geography, 12.03.2021 21:10