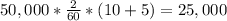

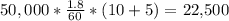

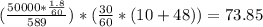

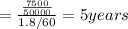

A machine that produces a certain piece must be turned off by the operator after each piece is completed. The machine "coasts" for 15 seconds after it is turned off, thus preventing the operator from removing the piece quickly before producing the next piece. An engineer has suggested installing a brake that would reduce the coasting time to 3 seconds. The machine produces 50,000 pieces a year. The time to produce one piece is 1 minute 45 seconds, excluding coastint time. The operator earns $10 an hour and other direct costs for operating the machine are $5 an hour. The brake will require servicing every 589 hours of operation. It will take the operator 30 minutes to perform the necessary maintenance and will require $48 in parts and material. The brake is expected to last 7,500 hours of operation (with proper maintenance) and will have no salvage value. How much could be spent for the brake if the Minimum Attractive Rate of Return is 10% compounded annually?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:30, AriaMartinez

Describe three scenarios in which you might utilize mathematics to investigate a crime scene, accident scene, or to make decisions involving police practice. be sure to explain how math is used in police as they work through each scenario.

Answers: 1

Business, 22.06.2019 11:40, avagracegirlp17zx2

On january 1, 2017, sophie's sunlounge owned 4 tanning beds valued at $20,000. during 2017, sophie's bought 3 new beds at a total cost of $14 comma 000, and at the end of the year the market value of all of sophie's beds was $24 comma 000. what was sophie's net investment

Answers: 3

Business, 22.06.2019 13:10, Mikey3414

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

You know the right answer?

A machine that produces a certain piece must be turned off by the operator after each piece is compl...

Questions in other subjects:

Mathematics, 05.05.2020 02:40

English, 05.05.2020 02:40

History, 05.05.2020 02:40

Mathematics, 05.05.2020 02:41

English, 05.05.2020 02:41