Determine financial statement amounts and prepare owner's equity statement.

(LO 4, 5)

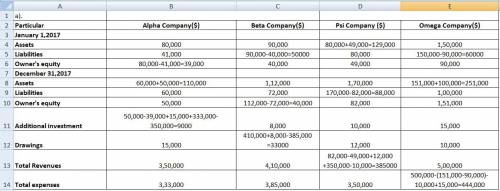

Financial statement information about four different companies is as follows.

Alpha CompanyBeta CompanyPsi CompanyOmega Company

January 1, 2017

Assets$ 80,000$ 90,000(g)$150,0 00

Liabilities  41,000(d)  80, 000(j)

Owner's equity(a)  40,000  49,000†‚ 90,000

December 31, 2017

Assets(b) 112,000 170,000(k)

Liabilities  60,000  72,000 (h) 100,000

Owner's equity  50,000(e)  82,000†‚151,000

Owner's equity changes in year

Additional investment(c)   8,000  10 ,000  15,000

Drawings  15,000(f)  12,000   10,000

Total revenues 350,000 410,000(i) 5 00,000

Total expenses 333,000 385,000 350, 000(l)

Instructions

(a)

Determine the missing amounts.

(Hint: For example, to solve for (a), Assets hyphen Liabilities equals Owner's equity equals dollar-sign Baseline 39,000.)

(b)

Prepare the owner's equity statement for Alpha Company.

(c)

Write a memorandum explaining the sequence for preparing financial statements and the interrelationship of the owner's equity statement to the income statement and balance sheet.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 16:00, ella3714

Three pounds of material a are required for each unit produced. the company has a policy of maintaining a stock of material a on hand at the end of each quarter equal to 30% of the next quarter's production needs for material a. a total of 35,000 pounds of material a are on hand to start the year. budgeted purchases of material a for the second quarter would be:

Answers: 1

Business, 22.06.2019 19:10, keenansimpkinsoy0oqc

Imagine us is a startup that offers high definition 3d prenatal ultrasounds for high-end customers. the service process includes four activities that are conducted in the sequence described below. (the time required for each activity is shown in parentheses): activity 1: welcome a patient and explain the procedure. (20 minutes)activity 2: prep the patient (e. g., show them to the room, apply ultrasound gel). (17 minutes) (*your id number represents the amount of time needed to complete this task)activity 3: take images. (5 minutes)activity 4: discuss diagnostic with patient. (20 minutes)at each location there are employees (servers) s1, s2, and s3. the assignment of tasks to servers is the following: s1 does activities 1 and 2.s2 does activity 3.s3 does activity 4.a. what is the capacity of this process (in customers per hour)? b. suppose 3 patients arrive every hour on average. ignoring any “start of day” or “end of day” effects, what are the utilizations of all three servers (%)? c. suppose each activity can be done by any server and any server can do any set of activities. however, each activity is done by only one server. for example, a possible assignment includes: s1 does activity 1, s2 does activity 2, and s3 does activities 3 and 4. of course, the original assignment of servers to activities is also feasible. what is the maximum capacity of the process (in customers per hour)? d. now consider the capacity measures in (c) and (a), what is the percentage change? why can you improve capacity without using additional resources? (there is no free lunch, right? )note: for all hw assignments, show your process of getting the results. only providing the final answers is not acceptable and will get 0%. if necessary, use a separate sheet of paper to show your work.

Answers: 3

Business, 22.06.2019 20:30, smarty5187

(30 total points) suppose a firm’s production function is given by q = l1/2*k1/2. the marginal product of labor and the marginal product of capital are given by: mpl = 1/ 2 1/ 2 2l k , and mpk = 1/ 2 1/ 2 2k l . a) (12 points) if the price of labor is w = 48, and the price of capital is r = 12, how much labor and capital should the firm hire in order to minimize the cost of production if the firm wants to produce output q = 18?

Answers: 1

Business, 22.06.2019 21:10, cece3467

Kinc. has provided the following data for the month of may: inventories: beginning ending work in process $ 17,000 $ 12,000 finished goods $ 46,000 $ 50,000 additional information: direct materials $ 57,000 direct labor cost $ 87,000 manufacturing overhead cost incurred $ 63,000 manufacturing overhead cost applied to work in process $ 61,000 any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. the adjusted cost of goods sold that appears on the income statement for may is:

Answers: 3

You know the right answer?

Determine financial statement amounts and prepare owner's equity statement.

(LO 4, 5)

F...

F...

Questions in other subjects:

Mathematics, 08.01.2022 05:30

Business, 08.01.2022 05:40

History, 08.01.2022 05:40

Mathematics, 08.01.2022 05:40

Mathematics, 08.01.2022 05:40

Mathematics, 08.01.2022 05:40

Mathematics, 08.01.2022 05:40