Business, 03.06.2020 00:59 hawleyemily

In late December you​ decide, for tax​ purposes, to sell a losing position that you hold in​ Twitter, which is listed on the​ NYSE, so that you can capture the loss and use it to offset some capital​ gains, thus reducing your taxes for the current year.​ However, since you still believe that Twitter is a good​ long-term investment, you wish to buy back your position in February the following year. To get this done you call your Charles Schwab brokerage account manager and request that he immediately sell your 1 comma 200 shares of Twitter and then in early February buy them back. Charles Schwab charges a commission of ​$4.95 for online stock trades and for​ broker-assisted trades there is an additional ​$25 service​ charge, so the total commission is ​$29.95.

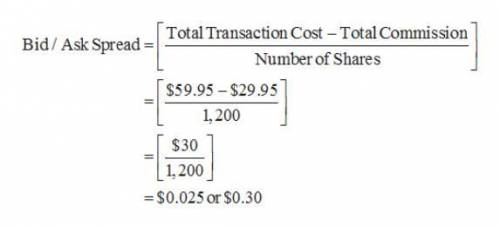

a. Suppose that your total transaction costs for selling the 1,400 shares of Twitter in December were $59.95. What was the bid/ask spread for Twitter at the time your trade was executed?

b. Given that Twitter is listed on the NYSE, do your total transaction costs for December seem reasonable? Explain why or why not.

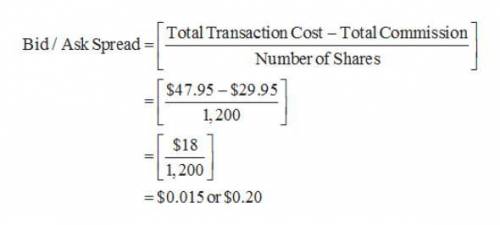

c. When your February statement arrives in the mail, you see that your total transaction costs for buying the 1,400 shares of Twitter were $47.95. What was the bid/ask spread for Twitter at the time your trade was executed?

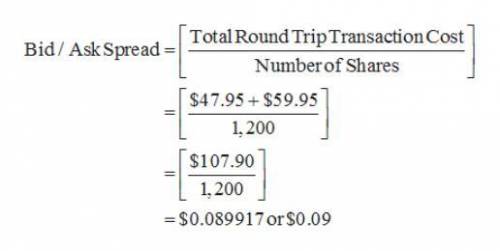

d. What are your total round-trip transaction costs for both selling and buying the shares, and what could you have done differently to reduce the total costs?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:00, janeou17xn

Put each of them in order. you are a young entrepreneur with a startup business. you now seek credit from the bank to expand it. what are the steps you will have to take? 1. you support your loan application with relevant documents. 2. you fill out the loan application form at the bank 3. you get an approval for the loan and the money is disbursed to your business account 4. you use the credit to further your business plan. 5. you have an interview with the loan officer and you explain your business plan.

Answers: 1

Business, 22.06.2019 03:00, itscheesycheedar

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 03:10, elijahcarson9015

Complete the sentences. upper a decrease in current income taxes the supply of loanable funds today because it a. decreases; increases disposable income, which decreases saving b. has no effect on; doesn't change expected future disposable income c. decreases; decreases expected future disposable income d. increases; increases disposable income, which encourages greater saving upper a decrease in expected future income a. increases the supply of loanable funds today because households with smaller expected future income will save more today b. has no effect on the supply of loanable funds c. decreases the supply of loanable funds because it decreases wealth d. decreases the supply of loanable funds today because households with smaller expected future income will save less today

Answers: 3

Business, 22.06.2019 03:10, hipstergirl225

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

You know the right answer?

In late December you​ decide, for tax​ purposes, to sell a losing position that you hold in​ T...

Questions in other subjects:

Arts, 23.06.2019 04:10

History, 23.06.2019 04:10

Business, 23.06.2019 04:20

Mathematics, 23.06.2019 04:20

Mathematics, 23.06.2019 04:20