Business, 29.05.2020 15:57 sarinaneedshelp01

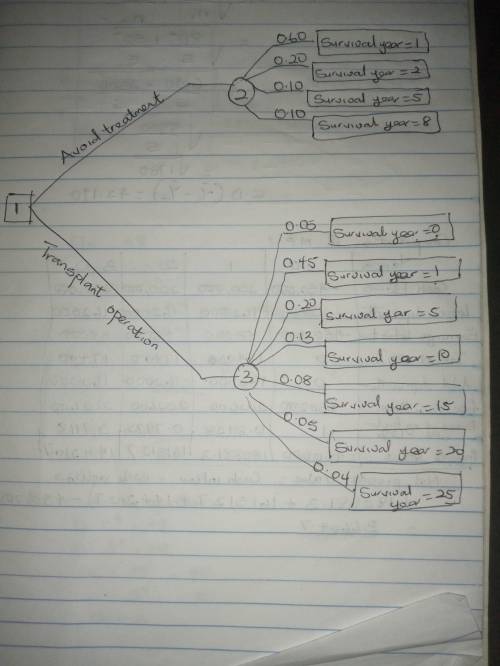

Henry Clinton, a robust 50-year-old executive living in the northern suburbs of St. Paul, has been diagnosed by a University of Minnesota internist as having a decaying liver. Although he is otherwise healthy, Clintons's liver problem could prove fatal if left untreated. Firm research data are not yet available to predict the likelihood of survival for a man of Clinton's age and condition without surgery. However, based on her own experience and recent medical journal articles, the internist tells him that if he elects to avoid surgical treatment of the liver problem, chances of survival will be approximated as follows: only a 60% chance of living 1 year, a 20% chance of surviving for 2 years, a 10% chance for 5 years, and a 10% chance of living to age 58. She places his probability of survival beyond age 58 without a liver transplant to be extremely low. The transplant operation, however, is a serious surgical procedure. Five percent of patients die during the operation or its recovery stage, with an additional 45% dying during the first year. Twenty percent survive for 5 years, 13% survive for 10 years, and 8%, 5%, and 4% survive, respectively, for 15, 20, and 25 years.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, saltyclamp

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 22.06.2019 11:50, 2kdragginppl

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i. e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i. e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

Business, 22.06.2019 16:10, ilovemusicandreading

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 16:50, cutebab4786

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

You know the right answer?

Henry Clinton, a robust 50-year-old executive living in the northern suburbs of St. Paul, has been d...

Questions in other subjects:

Social Studies, 05.12.2019 00:31

English, 05.12.2019 00:31

Health, 05.12.2019 00:31