Business, 28.05.2020 10:57 emilyrobles

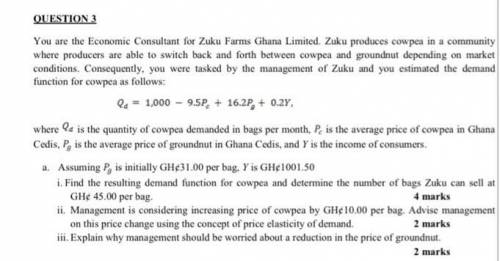

You are the Economic Consultant for Zuku Farms Ghana Limited. Zuku produces cowpea in a community

where producers are able to switch back and forth between cowpea and groundnut depending on market

conditions. Consequently, you were tasked by the management of Zuku and you estimated the demand

function for cowpea as follows:

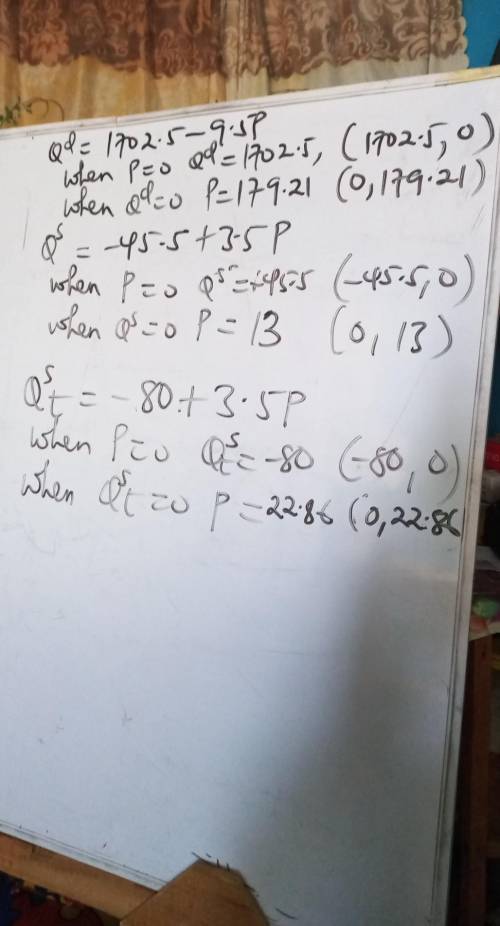

where is the quantity of cowpea demanded in bags per month, is the average price of cowpea in Ghana

Cedis, is the average price of groundnut in Ghana Cedis, and Y is the income of consumers.

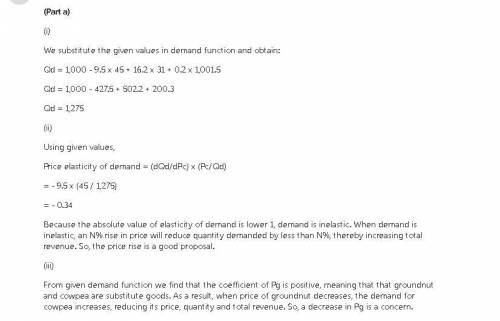

a. Assuming is initially GH¢31.00 per bag, Y is GH¢1001.50

i. Find the resulting demand function for cowpea and determine the number of bags Zuku can sell at

GH¢ 45.00 per bag. 4 marks

ii. Management is considering increasing price of cowpea by GH¢10.00 per bag. Advise management

on this price change using the concept of price elasticity of demand. 2 marks

iii. Explain why management should be worried about a reduction in the price of groundnut.

2 marks

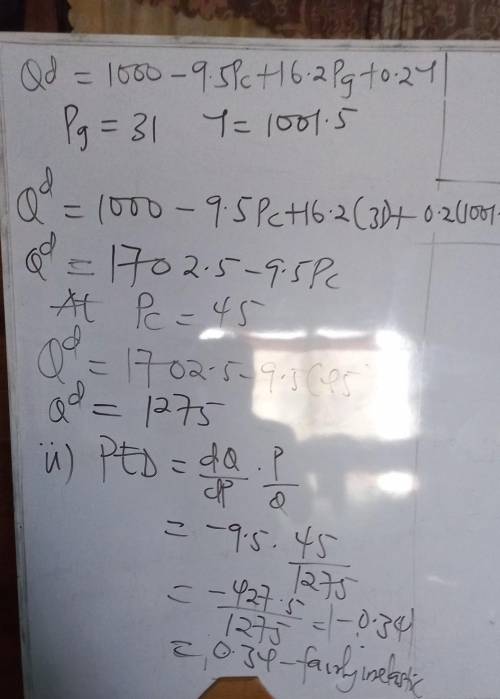

Assume also that your estimated supply function for cowpea as follows:

Where is the quantity supplied of cowpea in bags, and are as defined above, is the price of

fertilizer per bag, is the amount of rainfall (in inches).

If inches and = GH¢31.00.

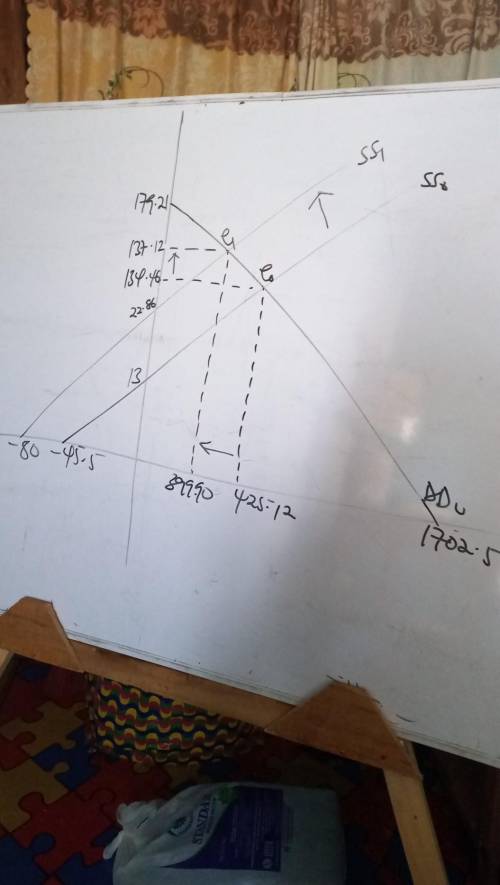

b. Find the resulting supply function for cowpea and determine the equilibrium price and quantity.

4 marks

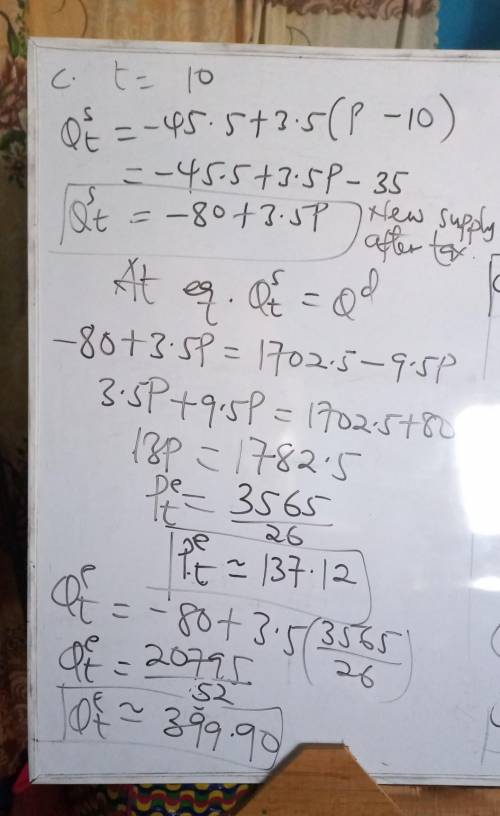

c. Assuming the government imposes a tax of GH¢10 on every bag of cowpea sold, determine the new

equilibrium price and quantity. Explain the effect of the policy on the market.

6 marks

d. Sketch the demand curve and the supply curves for cowp

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:10, Pipemacias1711

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u. s. parent on bank deposits held in london d. interest received by a u. s. parent on a loan to a subsidiary in mexico e. principal repayment received by u. s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u. s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 08:00, leannaadrian

Companies in the u. s. car rental market vary greatly in terms of the size of the fleet, the number of locations, and annual revenue. in 2011 hertz had 320,000 cars in service and annual revenue of approximately $4.2 billion. the following data show the number of cars in service (1000s) and the annual revenue ($ millions) for six smaller car rental companies (auto rental news website, august 7, 2012). excel file: data14-09.xls if required, enter negative values as negative numbers. a. select a scatter diagram with the number of cars in service as the independent variable. b. what does the scatter diagram developed in part (a) indicate about the relationship between the two variables? c. use the least squares method to develop the estimated regression equation (to 3 decimals). ŷ = + x d. for every additional car placed in service, estimate how much annual revenue will change. by $ e. fox rent a car has 11,000 cars in service. use the estimated regression equation developed in part (c) to predict annual revenue for fox rent a car. round your answer to nearest whole value. $ million hide feedback partially correct

Answers: 1

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

Business, 23.06.2019 01:50, adalan6986

Exhibit 34-1 country a country b good x 90 60 30 0 good ygood x good y 0 30 60 90 30 20 10 20 40 60 refer to exhibit 34-1. considering the data, which of the following term to? a. 1 unit of y for 1 unit of x b. 1 unit of y for 0.75 units of x c. 1 unit of y for 0.25 units of x d. 1 unit of y for 1.50 units of x e. all of the above s of trade would both countries agree 8. it -

Answers: 2

You know the right answer?

You are the Economic Consultant for Zuku Farms Ghana Limited. Zuku produces cowpea in a community

Questions in other subjects:

Mathematics, 07.05.2021 06:40

History, 07.05.2021 06:40

History, 07.05.2021 06:40

World Languages, 07.05.2021 06:40

Mathematics, 07.05.2021 06:40

Arts, 07.05.2021 06:40