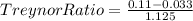

Portfolio A has an average return of 13.6 percent, a standard deviation of 17.2 percent, and a beta of 1.38. Portfolio B has an average return of 8.4 percent, a standard deviation of 6.4 percent, and a beta of 0.87. The risk-free rate is 3.3 percent and the market risk premium is 8.5 percent. What is the Treynor ratio of a portfolio comprised of 50 percent portfolio A and 50 percent portfolio B? Select one: a. 0.073 b. 0.054 c. 0.136 d. 0.114 e. 0.068

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, vlactawhalm29

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 22.06.2019 08:30, cyaransteenberg

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 11:40, ayoismeisalex

In each of the following, what happens to the unemployment rate? does the unemployment rate give an accurate impression of what’s happening in the labor market? a. esther lost her job and begins looking for a new one. b.sam, a steelworker who has been out of work since his mill closed last year, becomes discouraged and gives up looking for work. c.dan, the sole earner in his family of 5, just lost his $90,000 job as a research scientist. immediately, he takes a part-time job at starbucks until he can find another job in his field.

Answers: 2

Business, 22.06.2019 15:40, kaitlynmorgan43

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

You know the right answer?

Portfolio A has an average return of 13.6 percent, a standard deviation of 17.2 percent, and a beta...

Questions in other subjects:

English, 06.10.2019 00:00

Mathematics, 06.10.2019 00:00

Health, 06.10.2019 00:00

Physics, 06.10.2019 00:00

Health, 06.10.2019 00:00