Business, 24.05.2020 00:02 paigehixson9457

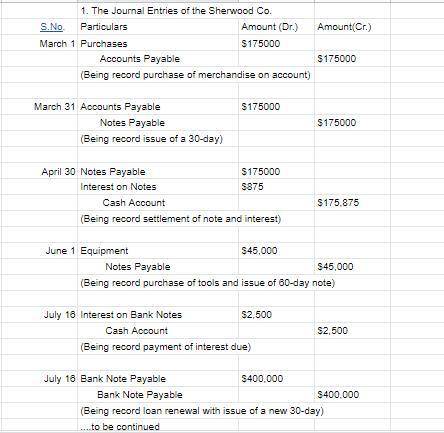

The following items were selected from among the transactions completed by Sherwood Co. during the current year:

Mar.

1 Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30.

31 Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account.

Apr.

30 Paid Kirkwood Co. the amount owed on the note of March 31.

Jun.

1 Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note.

Jul.

1 Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%.

16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.)

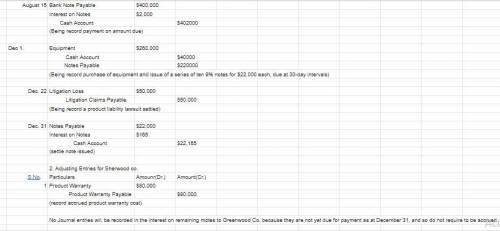

Aug.

15 Paid Triple Creek Bank the amount due on the note of July 16.

30 Paid Poulin Co. the amount due on the note of July 1.

Dec.

1 Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for $22,000 each, coming due at 30-day intervals.

22 Settled a product liability lawsuit with a customer for $50,000, payable in January. Accrued the loss in a litigation claims payable account.

31 Paid the amount due to Greenwood Co. on the first note in the series issued on December 1.

Required:1. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year.2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):a. Product warranty cost, $80,000.b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year. help needed please

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:50, smariedegray

Acompany set up a petty cash fund with $800. the disbursements are as follows: office supplies $300 shipping $50 postage $30 delivery expense $350 to create the fund, which account should be credited? a. postage b. cash at bank c. supplies d. petty cash

Answers: 2

Business, 22.06.2019 08:00, connermichaela

Who is not spending wisely? erika goes shopping and saves her receipts. she totals how much she spent and writes it down. mia needs to buy a new pair of shoes because she joined the soccer team. she looks at newspaper ads to find the best price. lauren has been thinking about getting a puppy for a long time. she walks by the pet store at the mall and decides to get a puppy. erin makes a purchase online using a credit card. she knows that she can pay the entire bill when it arrives.

Answers: 2

Business, 23.06.2019 01:00, bugsbunny27

Weekly sales at nancy's restaurant total $ 84,000. labor required is 420 hours at a cost of $21,000. raw materials used amount to $40,000. what is the partial measure of productivity for labor hours?

Answers: 1

Business, 23.06.2019 11:00, potatonene

Jessica thinks that everyone would be better off if financial institutions stopped issuing credit. which statement accurately supports her argument? people would pay less in interest fees. people would have greater protection in case of emergencies. people would need to save for many years to buy a home or open a business. people would support the economy through purchases of more goods and services.

Answers: 1

You know the right answer?

The following items were selected from among the transactions completed by Sherwood Co. during the c...

Questions in other subjects:

Mathematics, 15.01.2020 05:31

Mathematics, 15.01.2020 05:31

Physics, 15.01.2020 05:31

Mathematics, 15.01.2020 05:31

English, 15.01.2020 05:31

Physics, 15.01.2020 05:31