Business, 20.05.2020 16:58 monkeys450

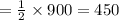

Use the following to answer the next 4 questions Suppose gold mining in the US was a perfectly competitive industry with N = 40 firms. Over the years Mr. Barrick purchased the all individual gold mines. The industry is now a monopoly owned by Mr. Barrick $ 70 60 40 30 MC = AC 10 20 30 40 50 60 Q MR 32) The profit Mr. Barrick earns as a monopolist is a. $700 b. $600 c. $900 d. $1000 e. none of the above 33) Before Mr. Barrick monopolized the industry, the total industry output of N = 40 competitive firms was Q = a. 20 b. 30 c. 40 d. 60 e. none of the above 34) After monopolization price per unit increased by a. 20 b. 30 c. 40 d. 60 e. none of the above 35) What is the extent of inefficiency (DWL = loss of total surplus) as a result of monopolization of what used to be a competitive industry? a. 450 b. 400 c. 500 d. 350 e. none of the above

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 09:50, niele123

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 22.06.2019 11:10, macylen3900

Verizon communications, inc., provides the following footnote relating to its leasing activities in its 10-k report. the aggregate minimum rental commitments under noncancelable leases for the periods shown at december 31, 2010, are as follows: years (dollars in millions) capital leases operatingleases 2011 $97 $1,898 2012 74 1,720 2013 70 1,471 2014 54 1,255 2015 42 1,012 thereafter 81 5,277 total minimum 418 $ 12,633 rental commitments less interest and (86) executory costs present value of 332 minimum lease payments less current (75) installments long-term obligation $257 at december 31, 2010 (a) confirm that verizon capitalized its capital leases using a rate of 7.4 %. (b) compute the present value of verizon's operating leases, assuming an 7.4% discount rate and rounding the remaining lease term to 3 decimal places. (use a financial calculator or excel to compute. do not round until your final answers. round each answer to the nearest whole number.)

Answers: 2

Business, 22.06.2019 18:00, Mw3spartan17

In which job role will you be creating e-papers, newsletters, and periodicals?

Answers: 1

Business, 22.06.2019 20:50, fathimasaynas2975

Lead time for one of your fastest-moving products is 20 days. demand during this period averages 90 units per day. a) what would be an appropriate reorder point? ) how does your answer change if demand during lead time doubles? ) how does your answer change if demand during lead time drops in half?

Answers: 1

You know the right answer?

Use the following to answer the next 4 questions Suppose gold mining in the US was a perfectly compe...

Questions in other subjects:

Mathematics, 10.06.2020 00:57

Social Studies, 10.06.2020 00:57

Mathematics, 10.06.2020 00:57