Business, 19.05.2020 15:18 savageyvens

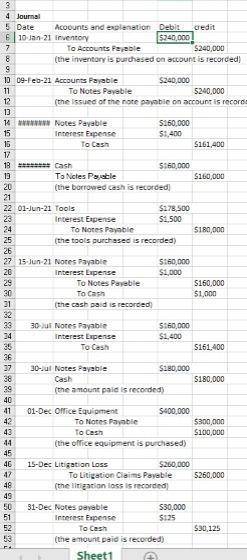

The following items were selected from among the transactions completed by O’Donnel Co. during the current year: Jan. 10. Purchased merchandise on account from Laine Co., $240,000, terms n/30. Feb. 9. Issued a 30-day, 4% note for $240,000 to Laine Co., on the account. Mar. 11. Paid Laine Co. the amount owed on the note of February 9. May 1. Borrowed $160,000 from Tabata Bank, issuing a 45-day, 5% note. June 1. Purchased tools by issuing a $180,000, 60-day note to Gibala Co., which discounted the note at the rate of 5%. 15. Paid Tabata Bank the interest due on the note of May 1 and renewed the loan by issuing a new 45-day, 7% note for $160,000. (Journalize both the debit and credit to the notes payable account.) July 30. Paid Tabata Bank the amount due on the note of June 15. 30. Paid Gibala Co. the amount due on the note of June 1. Dec. 1. Purchased office equipment from Warick Co. for $400,000, paying $100,000 and issuing a series of ten 5% notes for $30,000 each, coming due at 30-day intervals. 15. Settled a product liability lawsuit with a customer for $260,000, payable in January. O’Donnel accrued the loss in a litigation claims payable account. 31. Paid the amount due to Warick Co. on the first note in the series issued on December 1

1. Journalize the transactions. Refer to the Chart of Accounts for the exact wording of account titles. Assume a 360-day year.

2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):

a. Product warranty cost, $23,000.

b. Interest in the nine remaining notes owed to Warick Co. Assumes a 360-day year.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:30, karnun1201

Perez, inc., applies the equity method for its 25 percent investment in senior, inc. during 2018, perez sold goods with a 40 percent gross profit to senior, which sold all of these goods in 2018. how should perez report the effect of the intra-entity sale on its 2018 income statement?

Answers: 2

Business, 22.06.2019 12:10, felisha1234

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 23.06.2019 01:00, heyitstierney5610

Corporation had a japanese yen receivable resulting from exports to japan and a brazilian real payable resulting from imports from brazil. gracie recorded foreign exchange gains related to both its yen receivable and real payable. did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

Answers: 2

You know the right answer?

The following items were selected from among the transactions completed by O’Donnel Co. during the c...

Questions in other subjects:

Spanish, 01.04.2020 01:22

Mathematics, 01.04.2020 01:22

Biology, 01.04.2020 01:22