Business, 05.05.2020 00:35 jairopanda8

Assume the following annual financial information for Kelli (age 30):

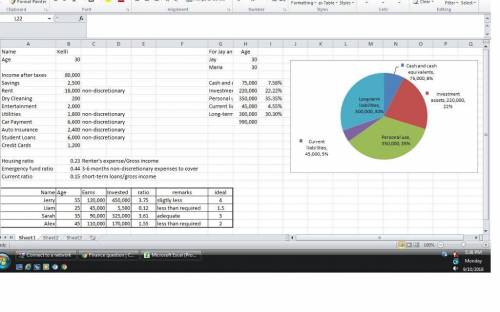

Income (after taxes) : $80,000

Savings : $2,500

Rent: $18,000

Dry Cleaning $200

Entertainment $2,000

Utilities $1,800

Car Payment $6,600

Auto Insurance $2,400

Student Loans $6,000

Credit Cards $1,200

Utilizing targeted benchmarks, which of the following statements is FALSE regarding Kelli’s financial situation?

a. Kelli's Housing Ratio 1 is adequate.

b. Kelli's emergency fund is adequate.

c. Kelli's Housing Ratio 2 is deficient.

d. Kelli's current ratio is less than 1

Utilizing investment assets to gross pay benchmarks, which of the following individuals is likely on target with their investment assets?

a. Jery age 55 earns $120,000 a year and has invested assets of $450,000.

b. Liam age 25 earns $45,000 a year and has invested assets of $5,500.

c. Sarah age 35 earns $90,000 a year and has invested assets of $325,000.

d. Alex age 45 earns $110,000 a year and has invested assets of $170,000.

Use the following financial information for Jay (age 30) and Maria (age 30) Handberger:

a. Cash and Cash Equivalents: $75,000

b. Investment Assets: $220,000

c. Personal Use Assets: $350,000

d. Current Liabilities: $45,000

e. Long-Term iabilities: $300,000

Before your next meeting with the Handberger's, you create a pie chart to visually depict their current balance sheet. Utilizing targeted benchmarks, which of the following statements are you most likely to make during your next meetang?

a. "Your investment assets make up 34% of your asset pie chart, which is too low for your age group.

b. "Given your assets and liabilities, your net worth is appropriate for your age group.

c. "Relative to the rest of your assets, your cash and cash equivalents are too low for your age group.

d. "Compared to your net worth and current liabilities, your long-term liabilities are excessive for your age group.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:50, dinero0424

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 22.06.2019 20:00, mooneyhope24

Experienced problem solvers always consider both the value and units of their answer to a problem. why?

Answers: 3

Business, 22.06.2019 22:50, PinkyUSA18

Which of these makes a student loan different from other types of loans

Answers: 1

Business, 23.06.2019 02:30, Bucsan8688

Arguments made against free trade include all of the following exceptdumping is an unfair trade practice that puts domestic producers of substitute goods at a disadvantage that they should be protected against. national defense considerations justify producing certain goods domestically whether the country has a comparative advantage in their production or not. free trade is inflationary and should be restricted in the domestic interest. if foreign governments subsidize their exports, foreign firms that export are given an unfair advantage that domestic producers should be protected against. infant industries should be protected from free trade so that they may have time to develop and compete on an even basis with older, more established foreign industries.

Answers: 3

You know the right answer?

Assume the following annual financial information for Kelli (age 30):

Income (after tax...

Income (after tax...

Questions in other subjects:

Mathematics, 16.04.2021 06:20

Mathematics, 16.04.2021 06:20

Social Studies, 16.04.2021 06:20

Mathematics, 16.04.2021 06:20

Mathematics, 16.04.2021 06:20

Biology, 16.04.2021 06:20

Mathematics, 16.04.2021 06:20