Business, 05.05.2020 06:53 tabocampos1414

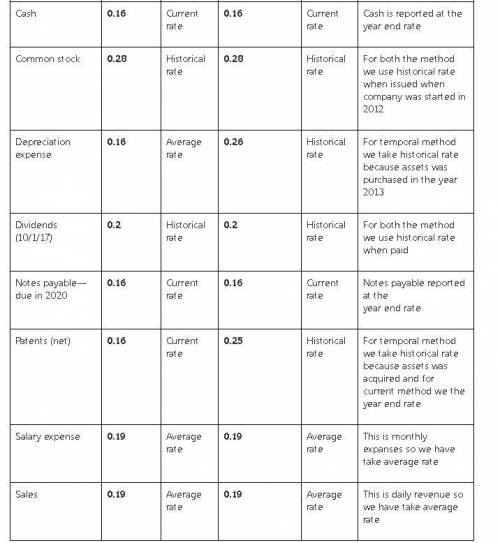

The following accounts are denominated in rubles as of December 31, 2017. For reporting purposes, these amounts need to be stated in U. S. dollars. For each balance, indicate the exchange rate that would be used if a translation is made under the current rate method. Then, again for each account, provide the exchange rate that would be necessary if a remeasurement is being made using the temporal method. The company was started in 2012. The buildings were acquired in 2013 and the patents in 2015.

Exchange rates for 1 rubles are as follows

2012 1 ruble = $0.28

2013 1 = 0.26

2015 1 = 0.25

January 1, 2017 1 = 0.24

April 1, 2017 1 = 0.23

July 1, 2017 1 = 0.22

October 1, 2017 = 0.20

December 1, 2017 1 = 0.16

Average for 2017 1 = 0.19

Asking for help to solve solutions on Translation and Remeasurement as follows:

Translation Remeasurement

Accounts payable Current rate Current rate

Accounts receivable Current rate Current rate

Accumulated depreciation—buildings Current rate Historical rate

Advertising expense Average rate Average rate

Amortization expense (patents) Average rate Historical rate

Buildings Current rate Historical rate

Cash Current rate Current rate

Common stock Historical rate Historical rate

Depreciation expense Average rate Historical rate

Dividends (10/1/17) Historical rate Historical rate

Notes payable—due in 2020 Current rate Current rate

Patents (net) Current rate Historical rate

Salary expense Average rate Average rate

Sales Average rate Average rate

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:30, weeblordd

Chip wilson has hired goldman sachs, an investment banking company, to assist him with a hostile takeover of lululemon. wilson's goal is to hire a new board of directors because he believes there is a need for a more long-term focus. goldman sachs is a proven firm at making a profit in every move that they make. if the hostile takeover does not pan out, what could be another motive for investors?

Answers: 1

Business, 22.06.2019 17:40, libi052207

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 19:30, janayshas84

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

Business, 22.06.2019 19:50, lucky1940

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

You know the right answer?

The following accounts are denominated in rubles as of December 31, 2017. For reporting purposes, th...

Questions in other subjects:

Health, 24.06.2019 10:00

English, 24.06.2019 10:00

History, 24.06.2019 10:00

Physics, 24.06.2019 10:00

Mathematics, 24.06.2019 10:00