Business, 05.05.2020 04:21 Christiancameron1234

You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 21 million. The cash flows from the project would be SF 5.9 million per year for the next five years. The dollar required return is 14 percent per year, and the current exchange rate is SF 1.11. The going rate on Eurodollars is 4 percent per year. It is 2 percent per year on Euroswiss.

Use the approximate form of interest rate parity in calculating the expected spot rates.

A) Convert the projected franc flows into dollar flows and calculate the NPV.

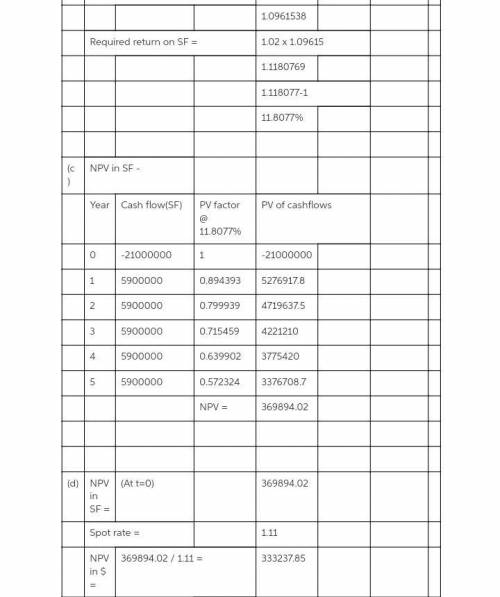

B) What is the required return on franc flows?

C) What is the NPV of the project in Swiss francs?

D) What is the NPV in dollars if you convert the franc NPV to dollars?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:50, pattydixon6

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 14:30, ayoismeisjjjjuan

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 22:50, emanuelmorales1515

Amonopolist’s inverse demand function is p = 150 – 3q. the company produces output at two facilities; the marginal cost of producing at facility 1 is mc1(q1) = 6q1, and the marginal cost of producing at facility 2 is mc2(q2) = 2q2.a. provide the equation for the monopolist’s marginal revenue function. (hint: recall that q1 + q2 = q.)mr(q) = 150 - 6 q1 - 3 q2b. determine the profit-maximizing level of output for each facility. output for facility 1: output for facility 2: c. determine the profit-maximizing price.$

Answers: 3

You know the right answer?

You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost o...

Questions in other subjects:

Mathematics, 04.06.2020 19:04

Mathematics, 04.06.2020 19:04

Mathematics, 04.06.2020 19:04