Business, 05.05.2020 17:18 AquaNerd5706

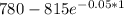

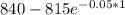

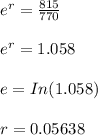

Suppose the S&R index is 800, the continuously compounded risk-free rate is 5%, and the dividend yield is 0%. A 1-year 815-strike European call costs $75 and a 1- year 815-strike European put costs $45. Consider the strategy of buying the stock, selling the 815-strike call, and buying the 815-strike put. a. What is the rate of return on this position held until the expiration of the options? b. What is the arbitrage implied by your answer to (a)? c. What difference between the call and put prices would eliminate arbitrage? d. What difference between the call and put prices eliminates arbitrage for strike prices of $780, $800, $820, and $840?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, Emptypockets451

Joe said “your speech was really great, i loved it.” his criticism lacks which component of effective feedback? a) he did not recognize his ethical obligations b) he did not focus on behavior c) he did not stress the positive d) he did not offer any specifics

Answers: 2

Business, 22.06.2019 22:00, lol9691

Gyou are in charge of making the work schedule for the next two weeks. typically this is not a difficult task as you work at a routine 8am – 5pm company. however, over the next two weeks you are required to schedule someone to be in the office each saturday. after contemplating this for a few days you make the schedule and assignments. before posting the schedule for everyone you decide that it is a good idea to meet personally with the two people you have scheduled to work the weekend. what do you say to them? what is your desired outcome?

Answers: 3

Business, 23.06.2019 00:00, dezmondpowell

Which of the following statements is true about an atm card?

Answers: 1

You know the right answer?

Suppose the S&R index is 800, the continuously compounded risk-free rate is 5%, and the dividend...

Questions in other subjects:

Mathematics, 07.01.2021 01:00

English, 07.01.2021 01:00

Mathematics, 07.01.2021 01:00

Chemistry, 07.01.2021 01:00

= $809.48

= $809.48

is the spike prices

is the spike prices