Business, 05.05.2020 17:15 isaacbryan2416

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee.

Gross Pay through August Gross Pay for September

a. $ 6,400 $ 800

b. $ 18,200 $ 2,100

c. $ 112,200 $ 8,000

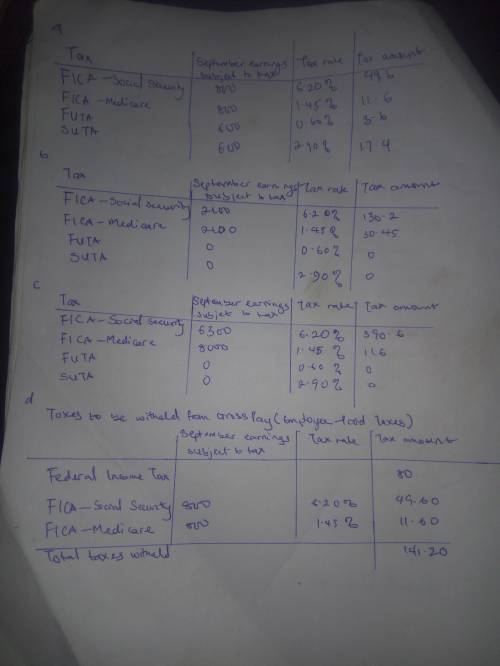

Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). (Round your answers to 2 decimal places.)

a.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

b.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

c.)

Tax September Earnings Subject to Tax Tax Rate Tax Amount

FICA-Social Security

FICA-Medicare

FUTA

SUTA

d.) Assuming situation a, prepare the employer’s September 30 journal entries to record salary expense and its related payroll liabilities for this employee. The employee’s federal income taxes withheld by the employer are $80 for this pay period. (Round your answers to 2 decimal places.)

Taxes to be Withheld From Gross Pay (Employee-Paid Taxes)

September Earnings Subject to Tax Tax Rate Tax Amount

Federal income tax

Total:

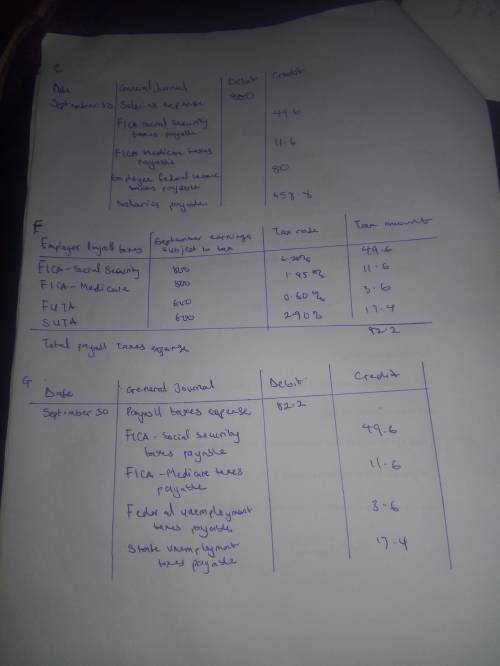

e. Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee.

DATE GENERAL JOURNAL DEBIT CREDIT

Sep 30

f.) Assuming situation a, prepare the employer’s September 30 journal entries to record the employer’s payroll taxes expense and its related liabilities. (Round your answers to 2 decimal places.)

Employer Payroll Taxes September earnings subject to tax Tax Rate Tax Amount

Total:

g.)

DATE GENERAL JOURNAL DEBIT CREDIT

Sep 30

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:50, marjae188jackson

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 12:20, ohgeezy

Consider 8.5 percent swiss franc/u. s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 20:50, NatalieZepeda

How has apple been able to sustain its competitive advantage in the smartphone industry? a. by reducing its network effects b. by targeting its new products and services toward laggards c. by driving the price for the end user to zero d. by regularly introducing incremental improvements in its products

Answers: 1

You know the right answer?

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its...

Questions in other subjects:

Mathematics, 07.07.2021 22:30

Engineering, 07.07.2021 22:30

Mathematics, 07.07.2021 22:30

Biology, 07.07.2021 22:30

English, 07.07.2021 22:30