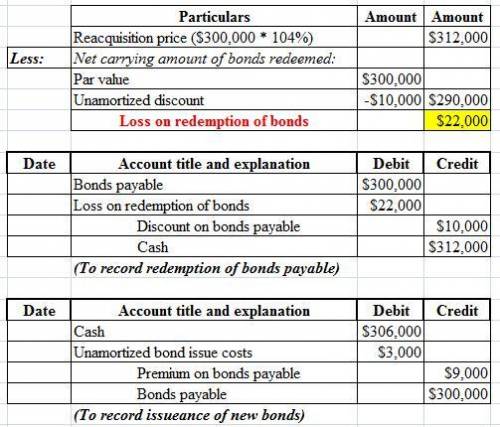

Linda Day George Company had bonds outstanding with a maturity value of $300,000. On April 30, 2014, when these bonds had an unamortized discount of $10,000, they were called in at 104. To pay for these bonds, George had issued other bonds a month earlier bearing a lower interest rate. The newly issued bonds had a life of 10 years. The new bonds were issued at 103 (face value $300,000). Issue costs related to the new bonds were $3,000.Ignoring interest, compute the gain or loss. (Round answer to 0 decimal places, e. g. 38,548.)Loss on redemption $Linda Day George Company had bonds outstanding witIgnoring interest, record this refunding transaction. (Round answers to 0 decimal places, e. g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)Account Titles and Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding wit(To record redemption of bonds payable.)Linda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding witLinda Day George Company had bonds outstanding wit

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:30, darius7967

True or false: a fitted model with more predictors will necessarily have a lower training set error than a model with fewer predictors.

Answers: 2

Business, 22.06.2019 19:40, gakodir

Last year ann arbor corp had $155,000 of assets, $305,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 37.5%. the new cfo believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. assets, sales, and the debt ratio would not be affected. by how much would the cost reduction improve the roe? a. 11.51%b. 12.11%c. 12.75%d. 13.42%e. 14.09%

Answers: 3

You know the right answer?

Linda Day George Company had bonds outstanding with a maturity value of $300,000. On April 30, 2014,...

Questions in other subjects:

Mathematics, 10.10.2019 21:30

Biology, 10.10.2019 21:30

Mathematics, 10.10.2019 21:30

Arts, 10.10.2019 21:30

SAT, 10.10.2019 21:30

German, 10.10.2019 21:30