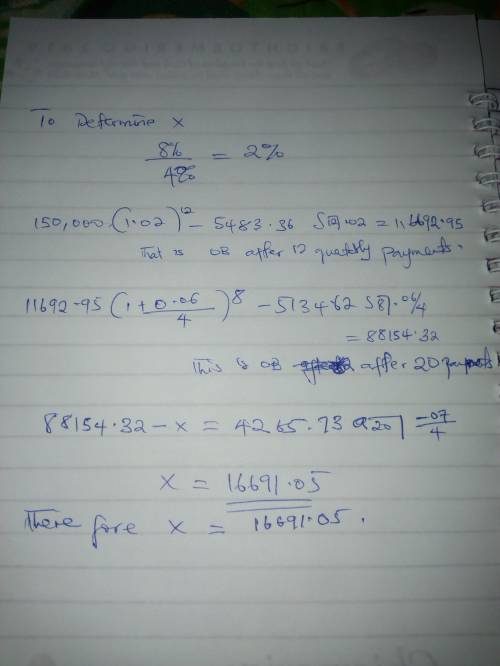

An investor took out a loan of 150,000 at 8% compounded quarterly, to be repaid over 10 years with quarterly payments of 5,483.36 at the end of each quarter. After 12 payments, the interest rate dropped to 6% compounded quarterly. The new quarterly payment dropped to 5,134.62. After 20 payments in total, the interest rate on the loan increased to 7% compounded quarterly. The investor decided to make an additional payment of

X at the time of his 20

th payment. After the additional payment was made, the new quarterly payment was calculated to be 4,265.73 payable for 5 more years. Determine X.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:10, Kaitneedshelps

1. descriptive statistics quickly describe large amounts of data can predict future stock returns with surprising accuracy statisticians understand non-numeric information, like colors refer mainly to patterns that can be found in data 2. a 15% return on a stock means that 15% of the original purchase price of the stock returns to the seller at the end of the year 15% of the people who purchased the stock will see a return the stock is worth 15% more at the end of the year than at the beginning the stock has lost 15% of its value since it was originally sold 3. a stock purchased on january 1 cost $4.35 per share. the same stock, sold on december 31 of the same year, brought in $4.75 per share. what was the approximate return on this stock? 0.09% 109% 1.09% 9% 4. a stock sells for $6.99 on december 31, providing the seller with a 6% annual return. what was the price of the stock at the beginning of the year? $6.59 $1.16 $7.42 $5.84

Answers: 3

Business, 22.06.2019 10:10, sydc1215

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

Business, 22.06.2019 10:20, alayciaruffin076

What two things do you consider when evaluating the time value of money

Answers: 1

Business, 22.06.2019 10:40, emojigirl5754

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

You know the right answer?

An investor took out a loan of 150,000 at 8% compounded quarterly, to be repaid over 10 years with q...

Questions in other subjects:

Mathematics, 22.01.2021 19:50

Computers and Technology, 22.01.2021 19:50

English, 22.01.2021 19:50

Mathematics, 22.01.2021 19:50