Business, 06.05.2020 03:27 thawkins79

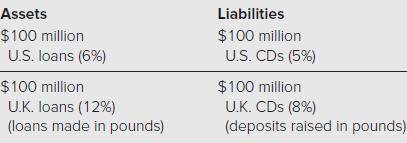

Suppose that instead of funding the $100 million investment in 12 percent British loans with U. S. CDs, the FI manager in problem 15 funds the British loans with $100 million equivalent one-year pound CDs at a rate of 8 percent. Now the balance sheet of the FI would be as follows:

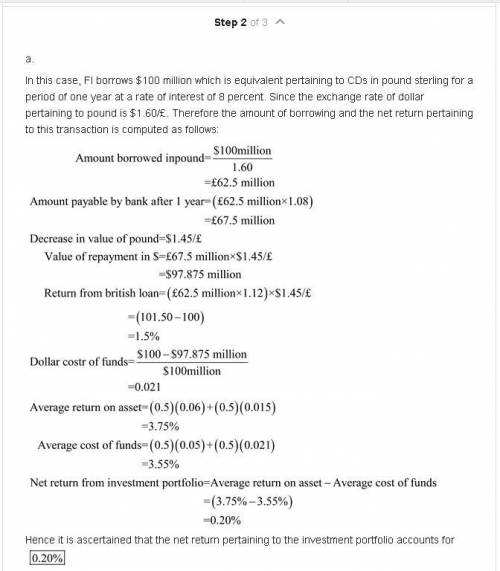

a. Calculate the return on the FI’s investment portfolio, the average cost of funds, and the net interest margin for the FI if the spot foreign exchange rate falls to $1.45/£1 over the year.

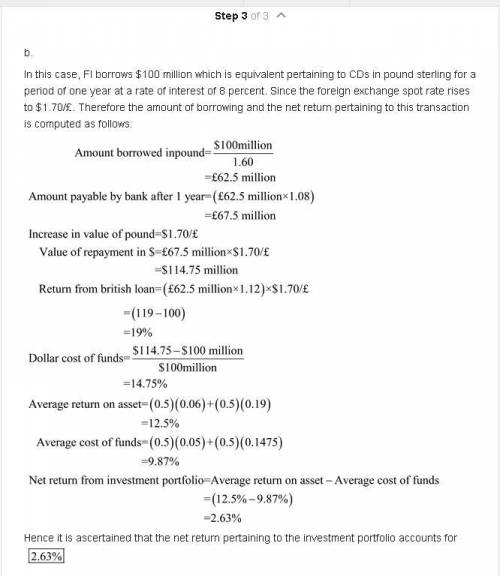

b. Calculate the return on the FI’s investment portfolio, the average cost of funds, and the net interest margin for the FI if the spot foreign exchange rate rises to $1.70/£1 over the year.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:20, sophiaa23

Reqwest llc agrees to sell one hundred servers to social media networks, inc. the servers, which social media networks expressly requires to have certain amounts of memory, are to be shipped “f. o.b. social media networks distribution center in tampa, fl.” when the servers arrive, social media networks rejects them and informs reqwest, claiming that the servers do not conform to social media networks’ memory requirement. a few hours later, the servers are destroyed in a fire at social media networks’ distribution center. will reqwest succeed in a suit against social media networks for the cost of the goods?

Answers: 3

Business, 22.06.2019 02:50, dreyes439

Grey company holds an overdue note receivable of $800,000 plus recorded accrued interest of $64,000. the effective interest rate is 8%. as the result of a court-imposed settlement on december 31, year 3, grey agreed to the following restructuring arrangement: reduced the principal obligation to $600,000.forgave the $64,000 accrued interest. extended the maturity date to december 31, year 5.annual interest of $40,000 is to be paid to grey on december 31, year 4 and year 5. the present value of the interest and principal payments to be received by grey company discounted for two years at 8% is $585,734. grey does not elect the fair value option for reporting the debt modification. on december 31, year 3, grey would recognize a valuation allowance for impaired loans of

Answers: 3

You know the right answer?

Suppose that instead of funding the $100 million investment in 12 percent British loans with U. S. C...

Questions in other subjects:

Social Studies, 11.04.2020 04:02

History, 11.04.2020 04:02