Business, 06.05.2020 03:22 ddcope1030

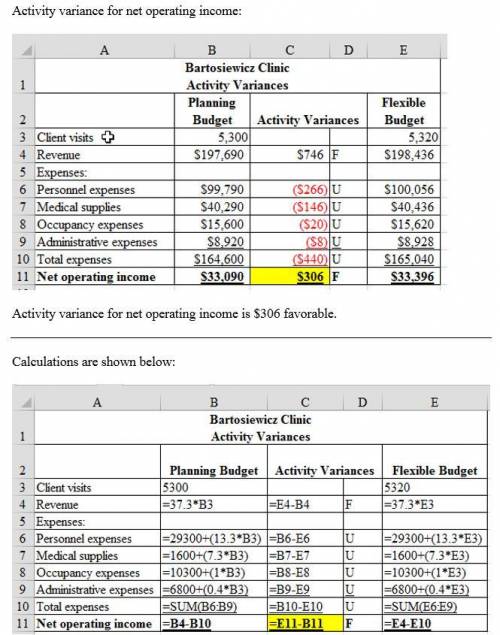

Bartosiewicz Clinic uses client-visits as its measure of activity. During January, the clinic budgeted for 5,300 client-visits, but its actual level of activity was 5,320 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for January: Data used in budgeting: Fixed element per month Variable element per client-visit Revenue - $ 37.30 Personnel expenses $ 29,300 $ 13.30 Medical supplies 1,600 7.30 Occupancy expenses 10,300 1.00 Administrative expenses 6,800 0.40 Total expenses $ 48,000 $ 22.00 Actual results for January: Revenue $ 150,300 Personnel expenses $ 70,090 Medical supplies $ 20,226 Occupancy expenses $ 14,100 Administrative expenses $ 7,580 The activity variance for net operating income in January would be closest to:

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:50, nayelimoormann

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 11:30, kaylabethany

Mai and chuck have been divorced since 2012. they have three boys, ages 6, 8, and 10. all of the boys live with mai and she receives child support from chuck. mai and chuck both work and the boys need child care before and after school. te boys attend the fun house day care center and mai paid them $2,000 and chuck paid them $3,000. mai's agi is $18,000 and chuck's is $29,000. mai will claim two of the boys as dependents. she signed form 8332 which allows chuck to claim one of the boys. who can take the child and dependent care credit?

Answers: 3

You know the right answer?

Bartosiewicz Clinic uses client-visits as its measure of activity. During January, the clinic budget...

Questions in other subjects:

French, 16.02.2021 17:20

Mathematics, 16.02.2021 17:20

Mathematics, 16.02.2021 17:20

Mathematics, 16.02.2021 17:20

Geography, 16.02.2021 17:20

Mathematics, 16.02.2021 17:20