Business, 06.05.2020 07:09 jamessmith86

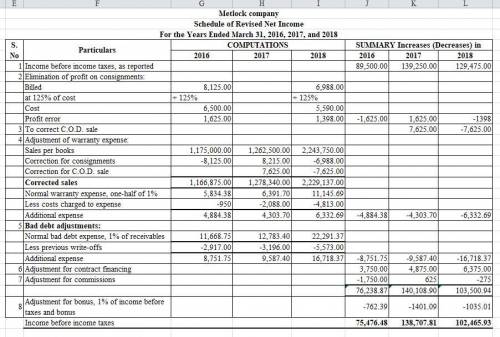

You have been asked by a client to review the records of Metlock Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following information.

1. Metlock Company commenced business on April 1, 2015, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes.

Year Ended March 31 Income Before Taxes

2016 $89,500

2017 139,250

2018 129,475

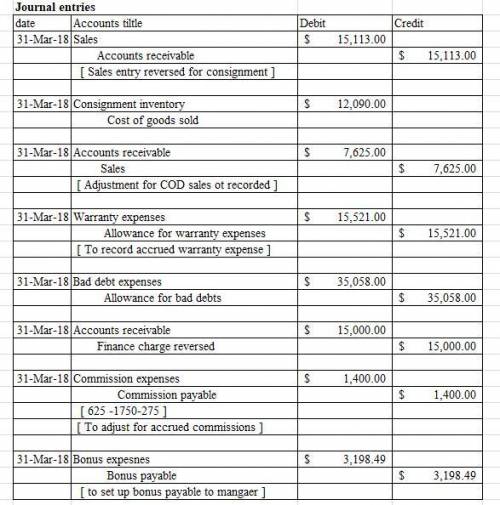

2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to:

2016 $8,125

2017 none

2018 6,988

Sales price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year.

3. On March 30, 2017, two machines were shipped to a customer on a C. O.D. basis. The sale was not entered until April 5, 2017, when cash was received for $7,625. The machines were not included in the inventory at March 31, 2017. (Title passed on March 30, 2017.)

4. All machines are sold subject to a 5-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to 1/2 of 1% of sales. The company has charged an expense account for warranty costs incurred.

Sales per books and warranty costs were as follows.

Warranty Expense for Sales Made in

Year Ended March 31 Sales 2016 2017 2018 Total

2016 $1,175,000 $950 $950

2017 1,262,500 450 $1,638 2,088

2018 2,243,750 400 2,025 $2,388 4,813

5. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 1% of receivables. Bad debts written off were:

Bad Debts Incurred on Sales Made in

2016 2017 2018 Total Bad Debt Expense Based on 1% of Receivables

2016 $938 $938 $2,917

2017 1,000 $650 1,650 3,196

2018 438 2,250 $2,125 4,813 5,573

6. The bank deducts 6% on all contracts financed. Of this amount, 1/2% is placed in a reserve to the credit of Metlock Company that is refunded to Metlock as finance contracts are paid in full. (Thus, Metlock should have a receivable for these payments and should record revenue when the net balance is remitted each year.) The reserve established by the bank has not been reflected in the books of Metlock. The excess of credits over debits (net increase) to the reserve account with Metlock on the books of the bank for each fiscal year were as follows.

2016 $3,750

2017 4,875

2018 6,375

$15,000

7. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows.

2016 $1,750

2017 1,125

2018 1,400

8. A review of the corporate minutes reveals the manager is entitled to a bonus of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid.

Required:

1. Present a schedule showing the revised income before income taxes for each of the years ended March 31, 2016, 2017, and 2018. (Enter negative amounts using either a negative sign preceding the number e. g. -15,000 or parentheses e. g. (15,000). Round answers to the nearest whole dollar, e. g. 5,275.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:30, junior2461

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 14:20, deisyy101

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

Business, 22.06.2019 19:00, 3peak101

Andy purchases only two goods, apples (a) and kumquats (k). he has an income of $125 and can buy apples at $5 per pound and kumquats at $5 per pound. his utility function is u(a, k) = 6a + 2k. what is his marginal utility for apples and his marginal utility for kumquats? andy's marginal utility for apples (mu subscript a) is mu subscript aequals 6 and his marginal utility for kumquats (mu subscript k) is

Answers: 2

Business, 22.06.2019 19:40, raymondleggett44

When a company produces and sells x thousand units per week, its total weekly profit is p thousand dollars, where upper p equals startfraction 800 x over 100 plus x squared endfraction . the production level at t weeks from the present is x equals 4 plus 2 t. find the marginal profit, startfraction dp over dx endfraction and the time rate of change of profit, startfraction dp over dt endfraction . how fast (with respect of time) are profits changing when tequals8?

Answers: 1

You know the right answer?

You have been asked by a client to review the records of Metlock Company, a small manufacturer of pr...

Questions in other subjects:

Mathematics, 08.10.2020 14:01

Mathematics, 08.10.2020 14:01