Last year, 46% of business owners gave a holiday gift to their employees. A

survey of business...

Business, 06.05.2020 08:02 homeschool0123

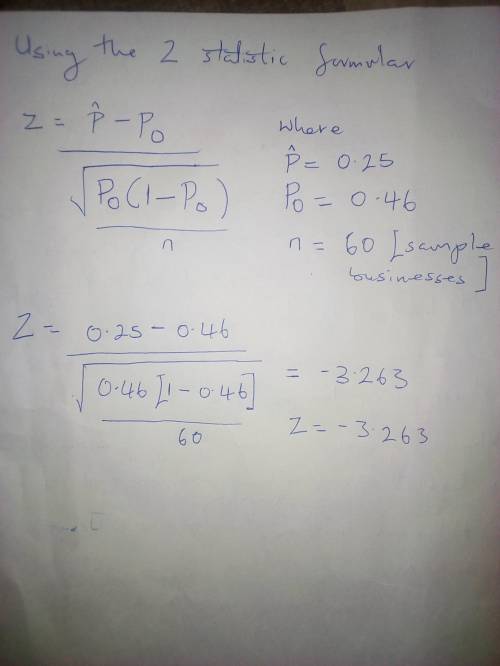

Last year, 46% of business owners gave a holiday gift to their employees. A

survey of business owners indicated that 25% plan to provide a holiday gift to

their employees. Suppose the survey results are based on a sample of 60 business

owners.

(a) How many business owners in the survey plan to provide a holiday gift to

their employees?

(b) Suppose the business owners in the sample do as they plan. Compute the p

value for a hypothesis test that can be used to determine if the proportion of

business owners providing holiday gifts has decreased from last year. If

required, round your answer to four decimal places. If your

enter "0". Do not round your intermediate calculations.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 00:20, randallmatthew6124

Suppose an economy consists of three sectors: energy (e), manufacturing (m), and agriculture (a). sector e sells 70% of its output to m and 30% to a. sector m sells 30% of its output to e, 50% to a, and retains the rest. sector a sells 15% of its output to e, 30% to m, and retains the rest.

Answers: 1

Business, 22.06.2019 11:30, zahradawkins2007

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

Business, 22.06.2019 15:00, WowOK417

Which of the following characteristics are emphasized in the accounting for state and local government entities? i. revenues should be matched with expenditures to measure success or failure of the government entity. ii. there is an emphasis on expendability of resources to accomplish objectives. a. i only b. ii only c. i and ii d. neither i nor ii

Answers: 2

Business, 22.06.2019 18:00, tifftiff22

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

You know the right answer?

Questions in other subjects:

History, 11.03.2021 21:30

Mathematics, 11.03.2021 21:30

Social Studies, 11.03.2021 21:30

History, 11.03.2021 21:30

Mathematics, 11.03.2021 21:30

Mathematics, 11.03.2021 21:30