Business, 25.04.2020 05:02 sujeyribetanco2216

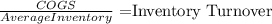

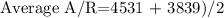

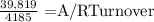

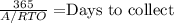

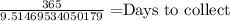

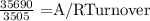

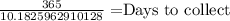

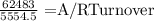

Cola Inc. Soda Co. Fiscal Year Ended: 2015 2014 2013 2015 2014 2013 Net Sales $ 39,819 $ 35,690 $ 36,444 $ 62,438 $ 47,932 $ 47,751 Accounts Receivable 4,588 3,903 3,231 6,557 4,804 3,874 Allowance for Doubtful Accounts 57 64 60 153 99 79 Accounts Receivable, Net of Allowance 4,531 3,839 3,171 6,404 4,705 3,795 Required: Calculate the receivables turnover ratios and days to collect for Cola Inc. and Soda Co. for 2015 and 2014. (Use 365 days in a year. Do not round intermediate calculations on Accounts Receivable Turnover Ratio. Round your final answers to 1 decimal place. Use final rounded answers from Accounts Receivable Turnover Ratio for Days to Collect ratio calculation.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:40, eamber646

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 07:00, aljalloh94

Ireally need with these questions.6. what level of job security do athletes and sports competitors have? why do you think this is? 22. do you think a musician has more job security than an athlete? explain.37. what is the difference between a public relations specialist and a marketing professional? 47. do you think gender inequalities still exist in the sports industry? explain.50. what are the advantages and disadvantages of labor unions? do you think labor unions are fair to employers? how might they be taken advantage of?

Answers: 1

Business, 22.06.2019 08:40, jasonr182017

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 14:20, deisyy101

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

You know the right answer?

Cola Inc. Soda Co. Fiscal Year Ended: 2015 2014 2013 2015 2014 2013 Net Sales $ 39,819 $ 35,690 $ 36...

Questions in other subjects:

English, 27.03.2020 01:48

History, 27.03.2020 01:48

Mathematics, 27.03.2020 01:48