Business, 25.04.2020 03:23 roxannaemigdio3850

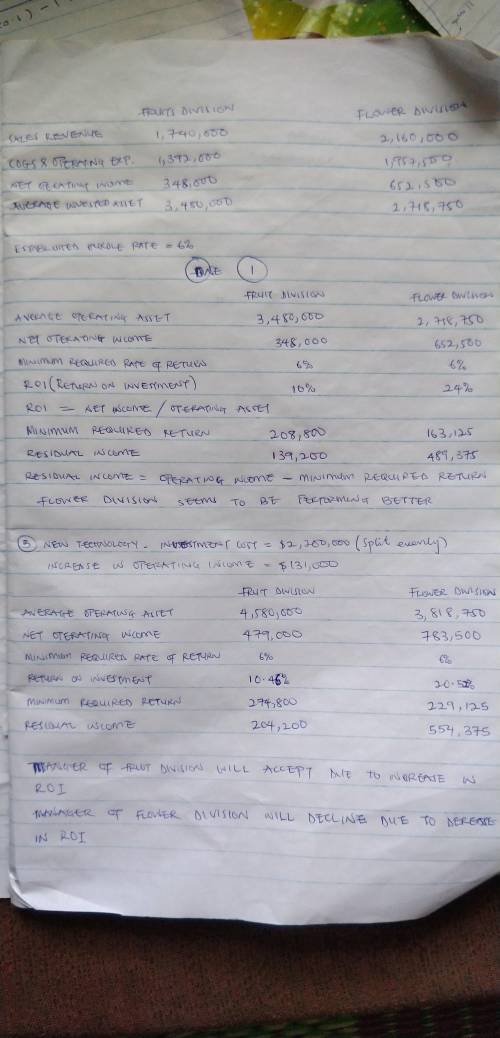

Orange Corp. has two divisions: Fruit and Flower. The following information for the past year is available for each division: Fruit Division Flower Division Sales revenue $ 1,740,000 $ 2,610,000 Cost of goods sold and operating expenses 1,392,000 1,957,500 Net operating income $ 348,000 $ 652,500 Average invested assets $ 3,480,000 $ 2,718,750 Orange has established a hurdle rate of 6 percent. Required: 1-a. Compute each division’s return on investment (ROI) and residual income for last year. 1-b. Determine which manager seems to be performing better. 2. Suppose Orange is investing in new technology that will increase each division’s operating income by $131,000. The total investment required is $2,200,000, which will be split evenly between the two divisions. Calculate the ROI and residual income for each division after the investment is made. 3. Determine whether both managers will support the investment.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:50, emma3216

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year. what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 21:00, nasrah

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

Business, 22.06.2019 21:30, marlenerojas201

Which of the following is one of the five fundamental questions? which products will be in scarce supply and which in excess supply? who should appoint the head of the central bank? how much should society save? correct what goods and services will be produced?

Answers: 1

Business, 22.06.2019 21:30, montgomerykarloxc24x

Sunset foods relies on a highly centralized functional structure to ensure consistency in the quality and taste of its products and to drive down costs via process innovations. however, as a consequence of its highly compartmentalized structure, the firm has found it difficult to transfer information and ideas from one department to the next. with the launch of its new line of breakfast foods coming up, how can sunset improve its ability to collaborate without sacrificing the benefits of its current structure

Answers: 1

You know the right answer?

Orange Corp. has two divisions: Fruit and Flower. The following information for the past year is ava...

Questions in other subjects:

World Languages, 04.03.2021 22:00

Mathematics, 04.03.2021 22:00

Biology, 04.03.2021 22:00

Social Studies, 04.03.2021 22:00

Mathematics, 04.03.2021 22:00

Mathematics, 04.03.2021 22:00