Business, 25.04.2020 03:16 punkinrichard1oxon2i

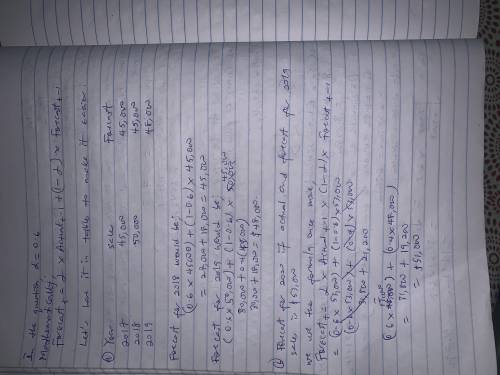

Using exponential smoothing with a weight of 0.6 on actual values:

a) If sales are $45,000 and $50,000 for 2017 and 2018, what would you forecast for 2019? (The first forecast is equal to the actual value of the preceding year)

b) Given the forecast and actual 2019 sales of $53,000, what would you forecast for 2020?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:00, avablankenship

Data pertaining to the current position of forte company are as follows: cash $437,500 marketable securities 170,000 accounts and notes receivable (net) 320,000 inventories 700,000 prepaid expenses 42,000 accounts payable 240,000 notes payable (short-term) 250,000 accrued expenses 310,000 required: 1. compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. round ratios to one decimal place. 2. compute the working capital, the current ratio, and the quick ratio after each of the following transactions, and record the results in the appropriate columns of the table provided. consider each transaction separately and assume that only that transaction affects the data given. round to one decimal place. a. sold marketable securities at no gain or loss, 75,000. b. paid accounts payable, 135,000. c. purchased goods on account, 100,000. d. paid notes payable, 105,000. e. declared a cash dividend, 125,000. f. declared a common stock dividend on common stock, 45,000. g. borrowed cash from bank on a long-term note, 205,000. h. received cash on account, 130,000. i. issued additional shares of stock for cash, 635,000. j. paid cash for prepaid expenses, 15,000.

Answers: 3

Business, 22.06.2019 04:00, tomboyswagge2887

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 06:00, StephanieQueen2003

For 2018, rahal's auto parts estimates bad debt expense at 1% of credit sales. the company reported accounts receivable and an allowance for uncollectible accounts of $86,500 and $2,100, respectively, at december 31, 2017. during 2018, rahal's credit sales and collections were $404,000 and $408,000, respectively, and $2,340 in accounts receivable were written off. rahal's accounts receivable at december 31, 2018, are:

Answers: 2

Business, 22.06.2019 11:30, deedivinya

What would you do as ceo to support the goals of japan airlines during the challenging economics that airlines face?

Answers: 1

You know the right answer?

Using exponential smoothing with a weight of 0.6 on actual values:

a) If sales are $45,000 and...

a) If sales are $45,000 and...

Questions in other subjects:

Social Studies, 17.09.2019 22:00

Mathematics, 17.09.2019 22:00