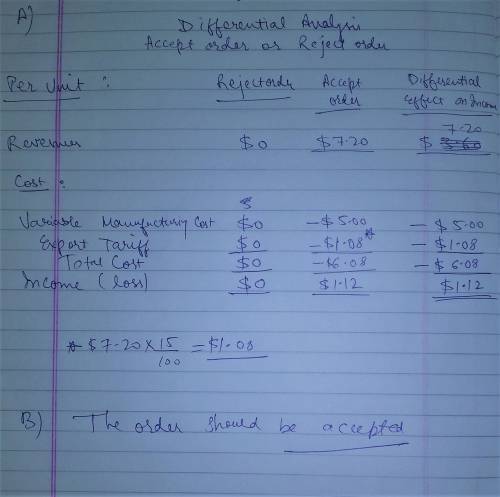

Product A is normally sold for $9.60 per unit. A special price of $7.20 is offered for the export market. The variable production cost is $5.00 per unit. An additional export tariff of 15% of revenue must be paid for all export products. Assume that there is sufficient capacity for the special order. Prepare a differential analysis dated March 16 on whether to reject (Alternative 1) or accept (Alternative 2) the special order. Round your answers to two decimal places. If an amount is zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) March 16 Reject Order (Alternative 1) Accept Order (Alternative 2) Differential Effect on Income (Alternative 2) Revenues, per unit $ $ $ Costs: Variable manufacturing costs, per unit Export tariff, per unit Income (Loss), per unit $ $ $ Should the special order be rejected (Alternative 1) or accepted (Alternative 2)?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:00, 544620

Answer the following questions using the information below: southwestern college is planning to hold a fund raising banquet at one of the local country clubs. it has two options for the banquet: option one: crestview country club a. fixed rental cost of $1,000 b. $12 per person for food option two: tallgrass country club a. fixed rental cost of $3,000 b. $8.00 per person for food southwestern college has budgeted $1,800 for administrative and marketing expenses. it plans to hire a band which will cost another $800. tickets are expected to be $30 per person. local business supporters will donate any other items required for the event. which option has the lowest breakeven point?

Answers: 1

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 20:00, pickelswolf3036

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

You know the right answer?

Product A is normally sold for $9.60 per unit. A special price of $7.20 is offered for the export ma...

Questions in other subjects:

Computers and Technology, 18.10.2019 08:30

Mathematics, 18.10.2019 08:30

Physics, 18.10.2019 08:30

Mathematics, 18.10.2019 08:30

Biology, 18.10.2019 08:30

Mathematics, 18.10.2019 08:30

Chemistry, 18.10.2019 08:30

Mathematics, 18.10.2019 08:30