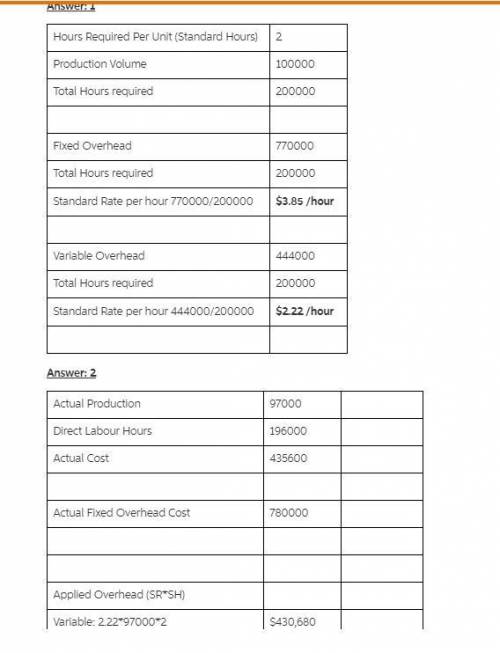

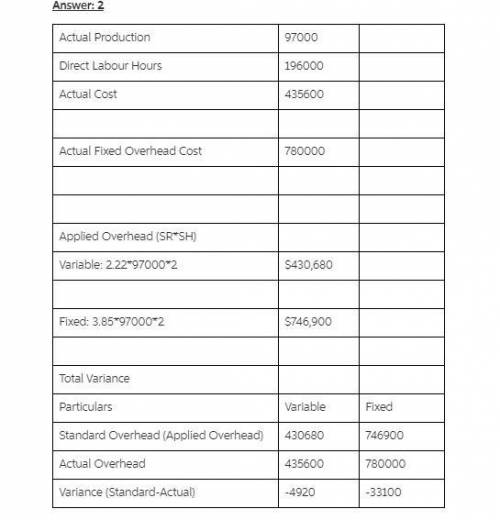

Overhead Application, Overhead Variances, Journal EntriesPlimpton Company produces countertop ovens. Plimpton uses a standard costing system. The standard costing system relies on direct labor hours to assign overhead costs to production. The direct labor standard indicates that two direct labor hours should be used for every oven produced. The normal production volume is 100,000 units. The budgeted overhead for the coming year is as follows:Fixed overhead $760,000Variable overhead 446,000**At normal volume. Plimpton applies overhead on the basis of direct labor hours. During the year, Plimpton produced 97,000 units, worked 196,000 direct labor hours, and incurred actual fixed overhead costs of $770,400 and actual variable overhead costs of $437,580.Required:1. Calculate the standard fixed overhead rate and the standard variable overhead rate. Round your answers to the nearest cent. Use rounded answers in the subsequent computations. Standard fixed overhead rate $ per direct labor hourStandard variable overhead rate $ per direct labor hour2. Compute the applied fixed overhead and the applied variable overhead. Use the application rates from part (1) in your calculations. Fixed $Variable $What is the total fixed overhead variance?$ UnfavorableWhat is the total variable overhead variance?$ Unfavorable3. Break down the total fixed overhead variance into a spending variance and a volume variance. Spending Variance $ UnfavorableVolume Variance $ Unfavorable4. Compute the variable overhead spending and efficiency variances. Spending Variance $ UnfavorableEfficiency Variance $ Unfavorable5. Now assume that Plimpton’s cost accounting system reveals only the total actual overhead. In this case, a three-variance analysis can be performed. Using the relationships between a three- and four-variance analysis, indicate the values for the three overhead variances. Volume variance $ UnfavorableVariable overhead efficiency variance $ UnfavorableSpending variance $ UnfavorableFeedback6. Prepare journal entries (1) to apply overhead to production, (2) to record the actual overhead costs incurred, (3) to record the variable and fixed overhead variances, and (4) to close the variance accounts at the end of the year. Assume variances are closed to Cost of Goods Sold. If an amount box does not require an entry, leave it blank or enter "0".

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:00, aubreyfoster

What should a food worker use to retrieve ice from an ice machine?

Answers: 1

Business, 22.06.2019 17:20, shakira11harvey6

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 19:00, nativebabydoll35

In north korea, a farmer’s income is the same as a dentist’s income. in a country with a mixed or market economy, the difference between those two professions might be more than 5 times different. how can you explain the fact that individuals doing the same work in different countries do not earn comparable salaries?

Answers: 1

Business, 22.06.2019 19:50, ParallelUniverse

Our uncle has $300,000 invested at 7.5%, and he now wants to retire. he wants to withdraw $35,000 at the end of each year, starting at the end of this year. he also wants to have $25,000 left to give you when he ceases to withdraw funds from the account. for how many years can he make the $35,000 withdrawals and still have $25,000 left in the end? a. 14.21b. 14.96c. 15.71d. 16.49e. 17.32

Answers: 1

You know the right answer?

Overhead Application, Overhead Variances, Journal EntriesPlimpton Company produces countertop ovens....

Questions in other subjects:

Mathematics, 23.02.2021 01:00

Spanish, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Biology, 23.02.2021 01:00

Physics, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Chemistry, 23.02.2021 01:00