Business, 23.04.2020 04:35 izzycheer7

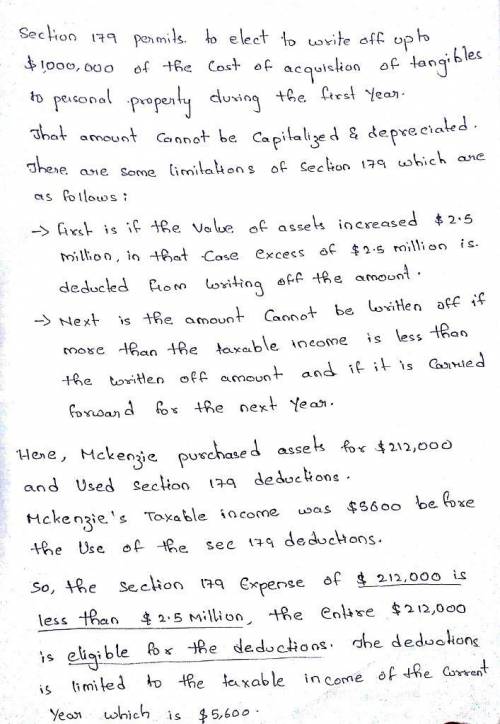

McKenzie purchased qualifying equipment for his business that cost $212,000 in 2018. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. If an amount is zero, enter "0".

a. McKenzie's § 179 expense deduction is $ 5,600 for 2018. His § 179 carryover to 2019 is $ 206,400 .

b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment? Hint: See Concept Summary 8.5. McKenzie's § 179 expense deduction is ? for 2018. His § 179 carryover to 2019 is ?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:30, indiareed0orv5ul

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

Business, 22.06.2019 23:30, glissman8459

What is the difference between career options in the law enforcement pathway and career options in the correction services pathway?

Answers: 1

Business, 23.06.2019 00:30, jordanbyrd33

Which of the following emails should he save in this folder instead of deleting or moving it to another folder

Answers: 1

Business, 23.06.2019 02:30, leapfroggiez

Congressman patrick indicates that he is opposed to tax proposals that call for a flat tax rate because the structure would not tax those individuals who have the ability to pay the tax. discuss the position of the congressman, giving consideration to tax rate structures (e. g., progressive, proportional, and regressive) and the concept of equity.

Answers: 3

You know the right answer?

McKenzie purchased qualifying equipment for his business that cost $212,000 in 2018. The taxable inc...

Questions in other subjects:

Mathematics, 28.01.2020 16:00

Mathematics, 28.01.2020 16:00

Mathematics, 28.01.2020 16:00

History, 28.01.2020 16:00