Business, 22.04.2020 16:33 sonnyboi2305

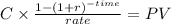

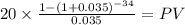

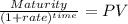

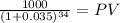

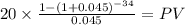

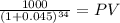

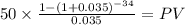

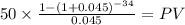

He Faulk Corp. has a bond with a coupon rate of 4 percent outstanding. The Yoo Company has a bond with a coupon rate of 10 percent outstanding. Both bonds have 17 years to maturity, make semiannual payments, and have a YTM of 7 percent. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:00, brendacauani12345

Evelyn would like to open a small business that is categorized as a being in the distribution industry. to do this she could open a establishment.

Answers: 1

Business, 21.06.2019 19:40, jonathanvega424

Your mother's well-diversified portfolio has an expected return of 12.0% and a beta of 1.20. she is in the process of buying 100 shares of safety corp. at $10 a share and adding it to her portfolio. safety has an expected return of 15.0% and a beta of 2.00. the total value of your current portfolio is $9,000. what will the expected return and beta on the portfolio be after the purchase of the safety stock?

Answers: 3

Business, 22.06.2019 21:40, QueenNerdy889

Which of the following comes after a period of recession in the business cycle? a. stagflation b. a drought c. a boom d. recovery

Answers: 1

Business, 22.06.2019 22:50, chrisraptorofficial

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

You know the right answer?

He Faulk Corp. has a bond with a coupon rate of 4 percent outstanding. The Yoo Company has a bond wi...

Questions in other subjects:

Mathematics, 01.12.2020 01:30

Spanish, 01.12.2020 01:30

Chemistry, 01.12.2020 01:30