Business, 22.04.2020 05:06 amylumey2005

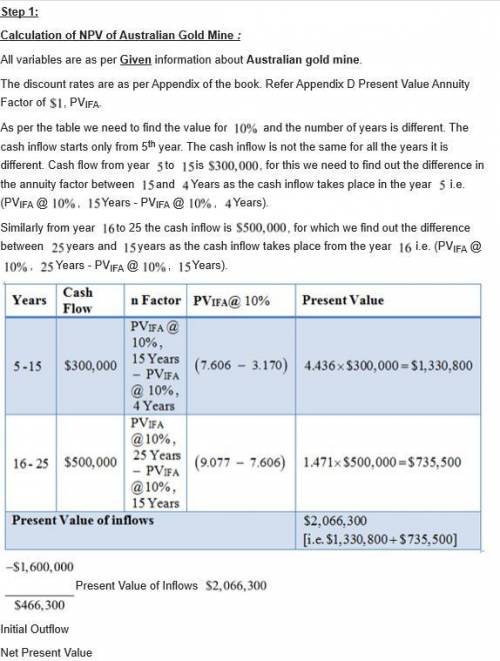

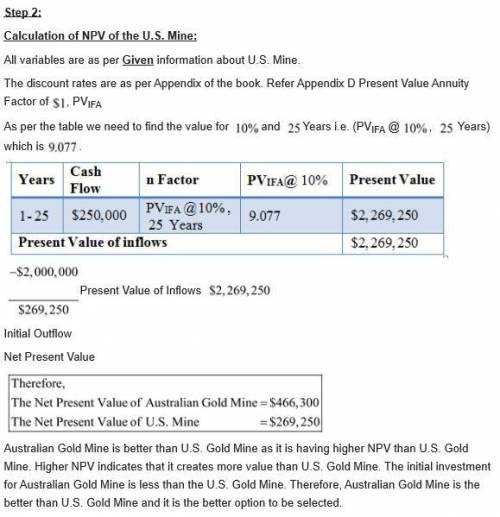

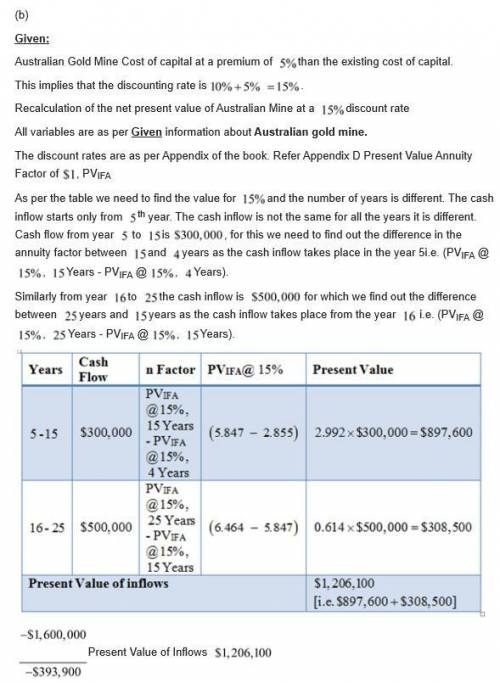

Highland Mining and Minerals Co. is considering the purchase of two gold mines. Only one investment will be made. The Australian gold mine will cost $1,600,000 and will produce $300,000 per year in years 5 through 15 and $500,000 per year in years 16 through 25. The U. S. gold mine will cost $2,000,000 and will produce $250,000 per year for the next 25 years. The cost of capital is 10 percent. Use Appendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this problem, you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:20, bisolad64

Accounts receivable arising from sales to customers amounted to $40,000 and $55,000 at the beginning and end of the year, respectively. income reported on the income statement for the year was $180,000. exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

Answers: 2

Business, 22.06.2019 07:30, natebarr17

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 20:50, ajsoccer1705

1. which one of the following would be an example of a supply-side market failure? a. a gas station is slowly leaking diesel fuel from its underground tanks, and after the leak is discovered, the business immediately cleans up the pollution at its own expense. b. a gas station is slowly leaking diesel fuel from its underground tanks, but the state uses taxpayer money to clean up the pollution rather than requiring the business to pay. c. your business wants to attract repeat customers by putting on a customer-appreciation picnic at a public park, but you decide not to because you couldn't prevent noncustomers from consuming the food and entertainment you provided. d. everyone rushes to the local retail outlet at midnight on the day of the release of a new video game console, and the store runs out before everyone is able to buy one.

Answers: 1

Business, 23.06.2019 00:10, pino2771

You are to receive five gold coins from your great uncle as an incentive to study hard. the coins were originally purchased in 1982. your great uncle will deliver the coins the week after finals (assuming your grades are "acceptable"). the amount your great uncle paid for the coins is a(n): indirect cost. overhead cost. opportunity cost. sunk cost.

Answers: 1

You know the right answer?

Highland Mining and Minerals Co. is considering the purchase of two gold mines. Only one investment...

Questions in other subjects:

Mathematics, 10.02.2020 22:41

English, 10.02.2020 22:42