Business, 22.04.2020 04:31 EnternalClipz

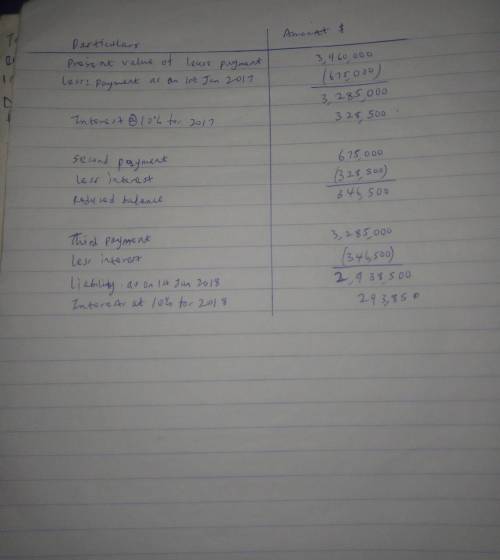

On January 1, 2017 Princess Corporation leased equipment to King Company. The lease is for 8 years. Equal payments of $675,000 were made annually, starting on January 1, 2017. The equipment cost Princess Corporation $3,600,000. The present value of the minimum lease payments is $3,960,000. The lease is appropriately classified as a sales-type lease. Assuming the interest rate for this lease is 10%, how much interest revenue will Princess record for the year 2018 on this lease

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:50, clwalling04

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning

Answers: 2

Business, 22.06.2019 11:50, Paytonsmommy09

Which of the following does not offer an opportunity for timely content? evergreen content news alerts content that suits seasonal consumption patterns content that matches a situational trigger content that addresses urgent pain points

Answers: 2

Business, 22.06.2019 16:30, sammuelanderson1371

Which of the following has the largest impact on opportunity cost

Answers: 3

Business, 22.06.2019 21:10, chimwim7515

The chromosome manufacturing company produces two products, x and y. the company president, jean mutation, is concerned about the fierce competition in the market for product x. she notes that competitors are selling x for a price well below chromosome's price of $13.50. at the same time, she notes that competitors are pricing product y almost twice as high as chromosome's price of $12.50.ms. mutation has obtained the following data for a recent time period: product x product y number of units 11,000 3,000 direct materials cost per unit $3.23 $3.09 direct labor cost per unit $2.22 $2.10 direct labor hours 10,000 3,500 machine hours 2,100 1,800 inspection hours 80 100 purchase orders 10 30ms. mutation has learned that overhead costs are assigned to products on the basis of direct labor hours. the overhead costs for this time period consisted of the following items: overhead cost item amount inspection costs $16,200 purchasing costs 8,000 machine costs 49,000 total $73,200using direct labor hours to allocate overhead costs determine the gross margin per unit for product x. choose the best answer from the list below. a. $1.93b. $3.12c. $7.38d. $2.43e. $1.73using activity-based costing for overhead allocation, determine the gross margin per unit for product y. choose best answer from list below. a. $10.07b. ($2.27)c. ($5.23)d. ($7.02)e. $7.02

Answers: 3

You know the right answer?

On January 1, 2017 Princess Corporation leased equipment to King Company. The lease is for 8 years....

Questions in other subjects:

Chemistry, 19.03.2020 09:29

History, 19.03.2020 09:29