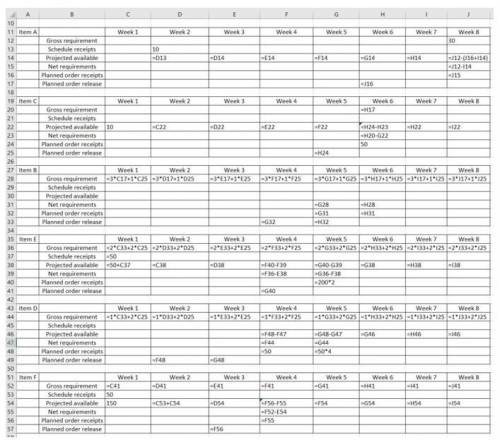

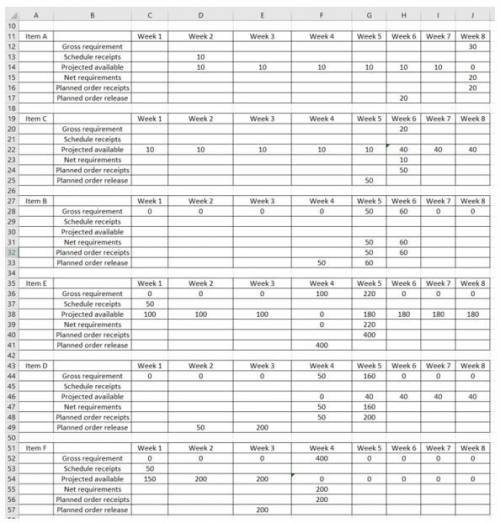

One unit of A is made of three units of B, one unit of C and two units of D. B is composed of two units of E and one unit of D. C is made of one unit of B and two units of E. E is made of one unit of F. Items B, C, E and F have one week lead times; A and D have lead times of two weeks. Assume that lot for lot (L4L) lot sizing is used for Items A, B, and F; lots of size 50, 50, and 200 are used for Items C, D, and E, respectively. Items C, E, and F have on hand (beginning) inventories of 10, 50, and 150, respectively; all other items have zero beginning inventory. We are scheduled to receive 10 units of A in week 2, 50 units of E in week 1, and also 50 units of F in week 1. There are no order scheduled receipts. If 30 units of A are required in week 8, use the low level coded bill of materials to find the necessary planned order releases for all components. Note: Simplify data handling to include the receipt of orders that have actually been placed in previous periods, the following six level scheme can be used. (A number of different techniques are used in practice, but the importance issue is to keep track of what is on hand, what is expected to arrive, what is needed, and what size orders should be placed.) One way to calculate the numbers is as follows:Gross requirementsScheduled receiptsProjected available balanceNet requirementsPlanned order receiptPlanned order release

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:30, tdyson3p6xvtu

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 13:30, starlodgb1971

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

Business, 22.06.2019 13:40, dathanboyd

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 16:50, taylorb9893

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

You know the right answer?

One unit of A is made of three units of B, one unit of C and two units of D. B is composed of two un...

Questions in other subjects:

Mathematics, 06.10.2019 15:00

English, 06.10.2019 15:00

History, 06.10.2019 15:00

Social Studies, 06.10.2019 15:00