Business, 22.04.2020 02:31 aliyahgregory

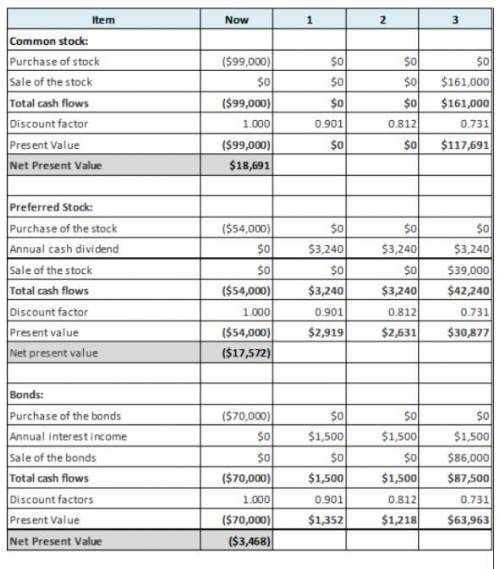

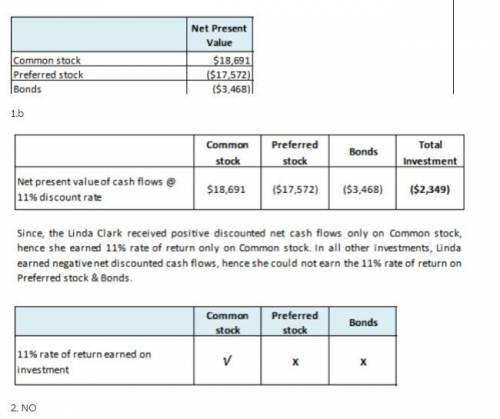

Linda Clark received $223,000 from her mother’s estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda’s behalf:a. Common stock was purchased at a cost of $99,000. The stock paid no dividends, but it was sold for $161,000 at the end of three years. b. Preferred stock was purchased at its par value of $54,000. The stock paid a 6% dividend (based on par value) each year for three years. At the end of three years, the stock was sold for $39,000.c. Bonds were purchased at a cost of $70,000. The bonds paid annual interest of $1,500. After three years, the bonds were sold for $86,000.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 18:30, miller5452

Amanufacturer has paid an engineering firm $200,000 to design a new plant, and it will cost another $2 million to build the plant. in the meantime, however, the manufacturer has learned of a foreign company that offers to build an equivalent plant for $2,100,000. what should the manufacturer do?

Answers: 1

Business, 23.06.2019 04:20, babycakesmani

Question 1 2 points is the concern of business for the long-range welfare of both the company and its relationships to the society within which it operates

Answers: 1

Business, 23.06.2019 15:00, kobiemajak

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

Business, 23.06.2019 15:30, bskyeb14579

World systems manufactures an optical switch that it uses in its final product. world systems incurred the following manufacturing costs when it produced 74 comma 000 units last​ year: ​(click the icon to view the manufacturing​ costs.) another company has offered to sell world systems the switch for $ 13.50 per unit. the world systems prepared an outsourcing decision analysis to show the cost per unit of making the switches versus the cost per unit of buying​ (outsourcing) the switches. ​(click the icon to view the outsourcing decision​ analysis.) world systems needs 86 comma 000 optical switches next year​ (assume same relevant​ range). by outsourcing​ them, world systems can use its idle facilities to manufacture another product that will contribute $ 140 comma 000 to operating​ income, but none of the fixed costs will be avoidable. should world systems make or buy the​ switches? show your analysis.

Answers: 2

You know the right answer?

Linda Clark received $223,000 from her mother’s estate. She placed the funds into the hands of a bro...

Questions in other subjects:

Mathematics, 10.05.2021 03:20

Mathematics, 10.05.2021 03:20

Mathematics, 10.05.2021 03:20

Mathematics, 10.05.2021 03:20

Mathematics, 10.05.2021 03:20

Mathematics, 10.05.2021 03:20

History, 10.05.2021 03:30