Business, 22.04.2020 02:31 queenkimm26

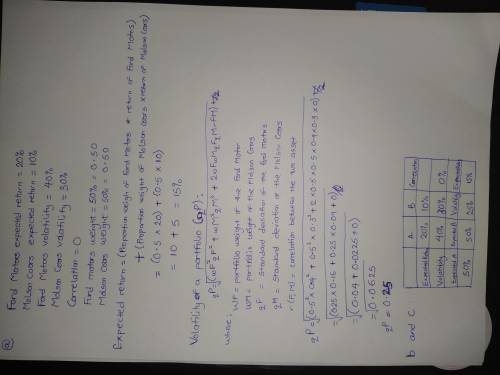

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors Brewing has an expected return of 10 % and a volatility of 30 %. If the two stocks are uncorrelated, a. What is the expected return and volatility of a portfolio consisting of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? b. Given your answer to (a), is investing all of your money in Molson Coors stock an efficient portfolio of these two stocks? c. Is investing all of your money in Ford Motor an efficient portfolio of these two stocks? a. What is the expected return and volatility of a portfolio of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? The expected return of the portfolio is

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:00, cameronbeaugh

Last week paul, ceo of quality furniture in south carolina, traveled to europe to visit customers. while overseas, paul checked his e-mail daily and showed his company's website to customers, explaining how the website will them place orders and receive merchandise more quickly. after visiting the last customer friday morning, paul was able to return to the corporate office in south carolina to meet with his board of directors that night. is the "shrinking" of time and space with air travel and electronic media.

Answers: 1

Business, 22.06.2019 18:00, lovecats12

Rosie and her brother michael decided recently to purchase an rv together. they both want to use the rv to take their families camping. the price of the rv was $10,000. since michael expects to use the rv 60% of the time and rosie 40% of the time, michael contributed $6,000 and rosie contributed $4,000. their ownership percentage equals their contribution percentage. which type of property titling should they use to reflect their ownership interest?

Answers: 1

Business, 22.06.2019 20:10, boofpack9775

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors B...

Questions in other subjects:

History, 05.04.2021 19:30

Health, 05.04.2021 19:30

Business, 05.04.2021 19:30

Computers and Technology, 05.04.2021 19:30

Business, 05.04.2021 19:30