Business, 21.04.2020 22:45 princessmaddiegigi

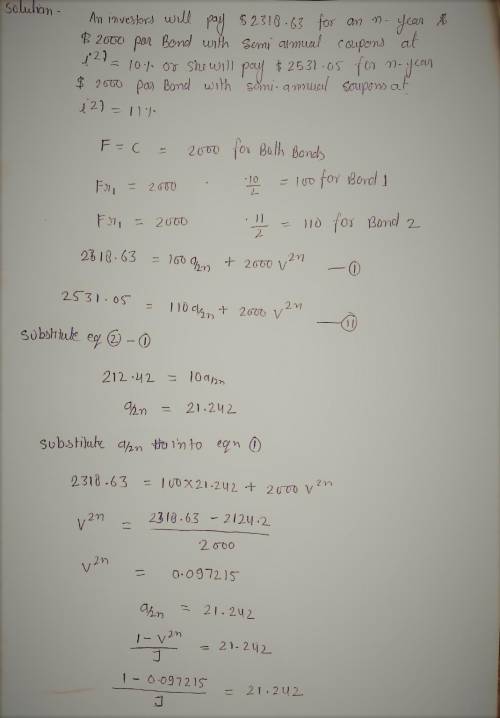

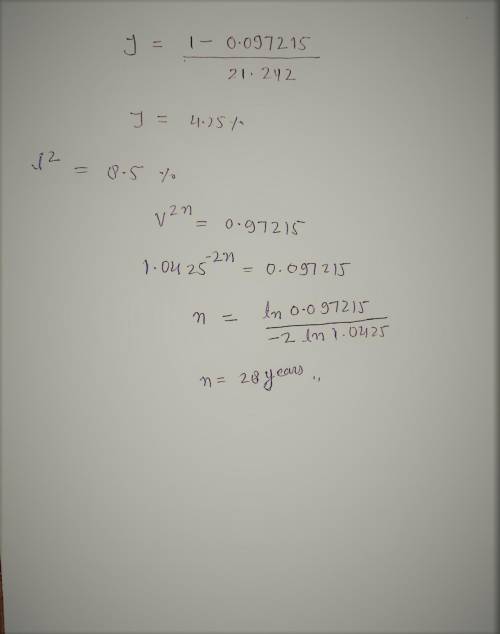

An investor will pay $2,318.63 for an n-year $2,000 par bond with a coupon rate of 10% compounded semiannually or he will pay $2,531.05 for an nyear $2,000 par bond with a coupon rate of 11% compounded semiannually. Assuming that the investor gets the same yield on the two bonds, find this yield rate expressed as a nominal rate convertible two times per year. Also find n.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:50, josephvcarter

Last year, western corporation had sales of $5 million, cost of goods sold of $3 million, operating expenses of $175,000 and depreciation of $125,000. the firm received $40,000 in dividend income and paid $200,000 in interest on loans. also, western sold stock during the year, receiving a $40,000 gain on stock owned 6 years, but losing $60,000 on stock owned 4 years. what is the firm's tax liability?

Answers: 2

Business, 22.06.2019 04:00, tomboyswagge2887

The simple interest in a loan of $200 at 10 percent interest per year is

Answers: 2

Business, 22.06.2019 12:30, bella51032

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 22.06.2019 12:50, montgomerykarloxc24x

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

You know the right answer?

An investor will pay $2,318.63 for an n-year $2,000 par bond with a coupon rate of 10% compounded se...

Questions in other subjects:

History, 05.05.2020 17:15

Mathematics, 05.05.2020 17:15