Business, 21.04.2020 19:00 mconcepcionmilp7rfkn

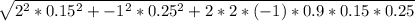

You have $ 10 comma 000 to invest. You decide to invest $ 20 comma 000 in Google and short sell $ 10 comma 000 worth of Yahoo! Google's expected return is 15 % with a volatility of 30 % and Yahoo!'s expected return is 12 % with a volatility of 25 %. The stocks have a correlation of 0.90. What is the expected return and volatility of the portfolio? The expected return is

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 15:20, sgalvis455

Abank has $132,000 in excess reserves and the required reserve ratio is 11 percent. this means the bank could have in checkable deposit liabilities and in (total) reserves.

Answers: 3

Business, 22.06.2019 19:50, hdkdkdbx

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

Business, 23.06.2019 02:20, jadenmenlovep7s7uj

You park your car on sixth street and walk over to the quad for lunch. while crossing wright street, you are hit by a bicyclist and knocked to the ground. you hit your head so hard you are knocked out. when you wake up, the person who hit you is gone. you incur $45,000 in medical bills. the person who hit you would be liable for $150,000 in damages if you could find them. your policy will pay:

Answers: 1

Business, 23.06.2019 16:30, makenziemartinez

Choose the term that best matches the description given. when the materials for the product are in short supply, but the demand is high, it is called

Answers: 1

You know the right answer?

You have $ 10 comma 000 to invest. You decide to invest $ 20 comma 000 in Google and short sell $ 10...

Questions in other subjects:

Mathematics, 30.11.2020 05:20

Chemistry, 30.11.2020 05:20

Mathematics, 30.11.2020 05:20

Chemistry, 30.11.2020 05:20

= 13.23

%

= 13.23

%