Business, 21.04.2020 05:15 liquidmana42

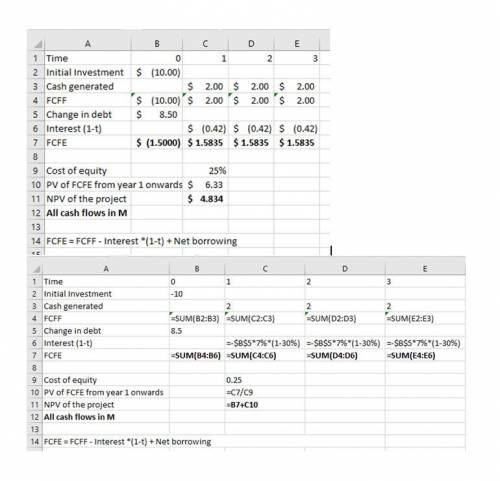

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thinking about expanding into Louisiana. This expansion will require an investment of $10M in free cash flows today, but will generate $2M in free cash flows every year forever. Financing for the expansion will consist of 10% equity and 90% debt. You use CAPM to estimate your cost of equity to be 25%, and this will be stable over time. Your cost of debt, however, is difficult to estimate—your debt consists of deposits, long-term debt, short-term debt, investment grade debt, and debt with different levels of collateral. However, you do know how much your debt will change over time, and the amount of your interest payments. To finance the project, you will issue a total of $8.5M in debt today, and this debt will stay constant. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. Your tax rate is 30%.What is the FCFE at time 0 (i. e. today)? (Hint: Since you just issued the debt, the interest payment at time 0 is simply zero.)A.+$1.5MB.+$1.0MC.-$1.0MD.-$1 .5M

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, jayjay5246

On july 1, 2016, killearn company acquired 103,000 of the outstanding shares of shaun company for $21 per share. this acquisition gave killearn a 40 percent ownership of shaun and allowed killearn to significantly influence the investee's decisions. as of july 1, 2016, the investee had assets with a book value of $6 million and liabilities of $1,468,500. at the time, shaun held equipment appraised at $140,000 above book value; it was considered to have a seven-year remaining life with no salvage value. shaun also held a copyright with a five-year remaining life on its books that was undervalued by $562,500. any remaining excess cost was attributable to goodwill. depreciation and amortization are computed using the straight-line method. killearn applies the equity method for its investment in shaun. shaun's policy is to declare and pay a $1 per share cash dividend every april 1 and october 1. shaun's income, earned evenly throughout each year, was $580,000 in 2016, $606,600 in 2017, and $649,200 in 2018. in addition, killearn sold inventory costing $93,000 to shaun for $155,000 during 2017. shaun resold $97,500 of this inventory during 2017 and the remaining $57,500 during 2018.a. determine the equity income to be recognized by killearn during each of these years. 2016 2017 2018b. compute killearn’s investment in shaun company’s balance as of december 31, 2018.

Answers: 2

Business, 22.06.2019 11:00, neash19

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 22.06.2019 11:10, evansh78

Use the following account numbers and corresponding account titles to answer the following question. account no. account title (1) cash (2) merchandise inventory (3) cost of goods sold (4) transportation-out (5) dividends (6) common stock (7) selling expense (8) loss on the sale of land (9) sales which accounts would appear on the income statement?

Answers: 3

Business, 22.06.2019 12:40, notorius315

Evan company reports net income of $232,000 each year and declares an annual cash dividend of $100,000. the company holds net assets of $2,130,000 on january 1, 2017. on that date, shalina purchases 40 percent of evan's outstanding common stock for $1,066,000, which gives it the ability to significantly influence evan. at the purchase date, the excess of shalina’s cost over its proportionate share of evan’s book value was assigned to goodwill. on december 31, 2019, what is the investment in evan company balance (equity method) in shalina’s financial records?

Answers: 2

You know the right answer?

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thi...

Questions in other subjects:

Biology, 07.10.2019 00:30

English, 07.10.2019 00:30

Mathematics, 07.10.2019 00:30

History, 07.10.2019 00:30

History, 07.10.2019 00:30